February 2007

Monthly Archive

Tue 27 Feb 2007

Posted by Jason G. under

Trading1 Comment

Today was a ridiculous day in the markets… incredible moves across almost everything. The Dow was down over 546 points intra-day, closing over 400 points down. The decline was so sharp that the “circuit breakers” were triggered.

Apparently the volume on the Dow Industrials was so high that, much to everyone’s surprise, the calculation of the index fell behind causing a rather odd appearance of a 200 point drop at 3pm. The reality was that the dow was falling much faster than it appeared, and at 3pm the system that calculates the index price caught up with reality. That should give conspiracy theorists something to talk about for a while…

What caused today’s plunge? In theory it was China’s stock market, losing nearly 9% overnight. I think that was a catalyst, but it was really just the first domino. I think a contributing factor was the number of US investors waiting for a correction to start, and everyone looking to exit their trades before prices start to move down… (more…)

Sun 25 Feb 2007

Posted by Jason G. under

Discussion[2] Comments

I just saw an ad that Investor’s Business Daily is having a “free pass” for the next week (Feb 26 to? March 4) on their online subscriber services.? I haven’t been dying to read IBD, but if it’s free I might look around a bit…

I know John has subscribed to IBD in the past…? what’s your take, what’s worth using, and does anything justify the subscription price when it stops being free?

Wed 14 Feb 2007

Posted by Jason G. under Uncategorized

No Comments

We probably all know about the CRB index, and it’s use as an index of commodities, and how it can be watched as a gague of the general level of commodities… Most importantly, the CRB index has been falling quite a bit since last August:

With the falling CRB, quite a few people have hopped on the commodity-bear bandwagon, claiming that commodities are falling because (insert your favorite reason here). Everything from a slowing economy to “this time it’s different”. (more…)

Tue 13 Feb 2007

Posted by Jason G. under

REITNo Comments

Here’s a quick, bearish article on REITs from Bloomberg…

Shares of U.S. REITs are the most expensive in more than two decades compared with Treasury notes after the five-year property boom. Real estate stocks have led the Standard & Poor’s 500 Index higher this year on speculation takeovers will increase after Blackstone agreed to buy Sam Zell’s Equity Office Properties Trust for $39 billion in the biggest-ever leveraged buyout.

“Sam Zell is probably the shrewdest operator in this field that there is,” said David Dreman, who oversees $21 billion at Dreman Value Management LLC in Jersey City, New Jersey. “If he’s selling, I don’t think I want to be a buyer.”

Remember when I suggested IGR for international REITs? I don’t think I emphasized the volatility enough… it was down over 5% yesterday, 11% in the last few days. It’s not a smooth ride… though the discount on the fund has gone up to almost 5% again.

Is it time to sell REITs? Hard to say… but so far we’ve only had 3 down days since a 52-week high (in the DJR). While losing 4% in 3 days is rough, it’s not that significant. We’ll have to wait and see how the sector continues to perform over the next few weeks…

Thu 8 Feb 2007

Posted by Jason G. under

ResearchNo Comments

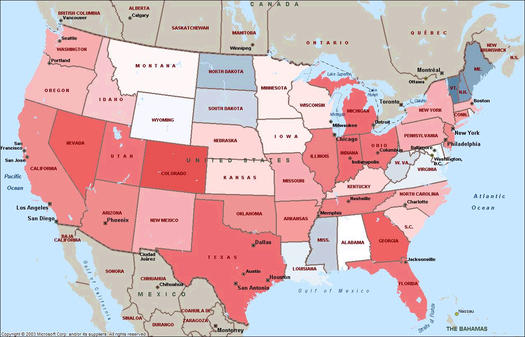

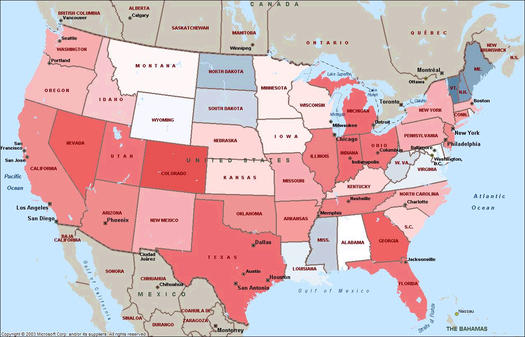

Another pretty picture from RealtyTrac via The Big Picture… this one shows the real estate/housing foreclosures by state… the redder the states, the more foreclosures per capita.

While the residential real estate market continues to soften, REITs are still going ganbusters (thanks to the EOP buyout), and homebuilders are doing quite well too.

Wed 7 Feb 2007

Posted by Jason G. under Uncategorized

No Comments

In case you’ve been missing volatility, according to Profunds’ website, they now offer ultra and ultrashort sector ETFs.? These are funds that aim to return either 2x or -2x the underlying sector’s return thanks to the use of leverage.? (You’d choose the -2x ultrashort funds when you think a sector will go down.)

Included in the new short funds, the Ultra (URE) or Ultrashort (SRS) Real Estate Fund, Ultra (DIG) or Ultrashort (DUG) Oil and Gas, Ultra (USD) or Ultrashort (SSG) Semiconductors…

Tue 6 Feb 2007

Posted by Jason G. under

CommentaryNo Comments

Paraphrased from Technically Speaking…? (you can tell which side he’s on based on the wording he uses…)

The Bear Case is simple:

- Mean reversion to growth norms

- P/E Multiple norms

- Dividend norms (1.8% on the SP500)

- Extremely low mutual fund cash

- Rising interest rates with a questionable dollar, under constant pressure from the printing press.

The Bull Case is equally simple:

- “WooHoo”

- “This time it’s different

- “The trend is your friend”

- “I can get out any time”

- “Debt doesn’t matter”

- The US consumer will never give up

- The Bernanke Put

- Victor Sperandeo’s “follow the false train of hope to the end of the line, and jump off just before the end.”

I think this sums things up fairly concisely… though I would probably add a few more strong profits stories to the bullish side, and some additional inflation stories to the bearish side…

Mon 5 Feb 2007

Posted by Jason G. under

CommentaryNo Comments

The Kirk Report has a good post on the 48 Laws of Power…? and how the laws might apply to traders.? While many might be questionable, some are quite good, such as:

9. Win through your actions, never through argument. (Don’t waste time convincing others on message boards how good or bad a stock is and/or telling people how smart you were because of good calls you’ve made in the past. Instead, trade the stock and make your profit. Talk will never pay your bills. Show others by demonstration, not by time wasting chatter.)

Sun 4 Feb 2007

Posted by Jason G. under

CommentaryNo Comments

From the Financial News by way of DealBook:

Some investors are deterred by funds that charge fees below the standard scale of 1.5% to 2% management fees and 20% performance fees.

A partner at a multibillion-[dollar] hedge fund manager said some had declined to invest in a new fund it launched because its fees were low: ?They could not take us seriously,? he said.

Just like with many products aimed at the high end of the market, a high price gives a perception of high value regardless of actual ability to deliver that higher value.

Sat 3 Feb 2007

Posted by Jason G. under

Research1 Comment

From FT Alphaville:

Red Kite Management, a $1bn metals-trading hedge fund, has suffered losses of up to 15 per cent so far this year… The news sparked heavy falls on the metals markets…

The report had a marked impact in the metals markets on Friday afternoon. In trading on the London Metal Exchange the price of copper fell 6 per cent, while aluminium was down 3 per cent and zinc slumped more than 8 per cent. ?Fund liquidation?a lot of stops triggered?a lot of the stuff on the back of the Red Kite news,? another trader told Reuters.

While a 15 to 20% loss doesn’t seem so bad, the fact that it has occurred in the last 5 weeks may be a harbinger of more trouble… (more…)