Tue 27 Feb 2007

Today was a ridiculous day in the markets… incredible moves across almost everything. The Dow was down over 546 points intra-day, closing over 400 points down. The decline was so sharp that the “circuit breakers” were triggered.

Apparently the volume on the Dow Industrials was so high that, much to everyone’s surprise, the calculation of the index fell behind causing a rather odd appearance of a 200 point drop at 3pm. The reality was that the dow was falling much faster than it appeared, and at 3pm the system that calculates the index price caught up with reality. That should give conspiracy theorists something to talk about for a while…

What caused today’s plunge? In theory it was China’s stock market, losing nearly 9% overnight. I think that was a catalyst, but it was really just the first domino. I think a contributing factor was the number of US investors waiting for a correction to start, and everyone looking to exit their trades before prices start to move down…

It reminds me of a line from my post a couple of weeks ago titled Summing Up, “I can get out any time.” Today should be a reminder that you can get out, but might not be able to get out at the price you want.

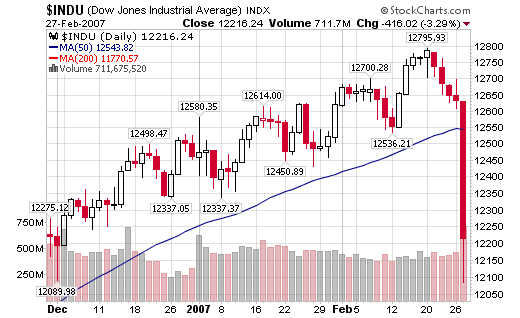

Here’s a 3 month chart of the Dow Industrials:

As you can see, today’s decline just wiped out three months worth of gains.

So, now the important question, what should you do after today’s decline? It depends on your objectives. If you’re investing for the next 40 years, today shouldn’t be that important. If you’re a shorter-term trader, today means an awful lot more. Do you know which one you are?

I for one had several positions that follow the “I can get out any time” theme, positions that I was not planning on holding for 40 years, let alone 4 months. I exited those positions today. In total, I sold close to a fourth of my open positions. In general my portfolio balance took quite a whallop with today’s price action.

Why didn’t I sell the rest? Three things… First, many of my positions are gold related, and gold should be counter-cyclical (with several caveats — gold stocks still trade in sympathy with other stocks in the short term, hence the 7.5% rout today). Second and third, the VIX and the Put/Call ratio. Both spiked higher today to incredibly high levels, indicating an extreme in sentiment — in today’s case, extreme fear… As the old saying goes, “buy when others are fearful and sell when others are greedy.”

So, if the VIX and Put/Call ratio are indicating extreme fear, why didn’t I buy today? Why did I close the positions that I did? My first objective is to avoid unnecessary risk, and that’s what drives my actions first, and why I closed the positions that I did. I’m happier waiting in cash to see which way this market will continue before I put on more trades. Also, the VIX and Put/Call are good indicators, until they aren’t… today’s high may be tomorrow’s low, and fear can continue to get more and more extreme for a long time before it turns.

An important point to make… almost everything went down today, including the things that are typically counter-cyclical (like gold or the utilities) or typically uncorrelated (like REITs or timber). This can happen because short-term (daily) movements aren’t usually significant; it can also happen if traders get margin calls or simply lower their leverage (a la a liquidity contraction). If a hedge fund needs to raise money, they may sell off unrelated assets, causing those to go down at the same time. It’s unusual and frustrating to try and understand, but we should see different behavior in the medium and longer time frames (months and years respectively).

What should we watch tomorrow, and over the next several days or weeks?

- The Yen – if it continues to rise that could cause problems with the Yen/USD carry trade and cause some institutional investors to start to unwind some of their leverage.

- The Nasdaq 100 ($NDX) – traders will consider an NDX drop below support at 1730 to 1750 to be a bad omen…

- The Broker/Dealer Sector ($XBD) – it tends to lead the general markets, so if we see continued weakness here, watch out below.

Hopefully these things can help us understand early whether today was the beginning of a new bear market, or just another correction in a continuing upward trend like last May…

February 27th, 2007 at 7:31 pm

A quick thought (from here) — today’s market decline comes dangerously close to the end of the month. Quite a few traders manage their performance month to month and we could see some craziness as they try to adjust with only one day before the end of February…