Tue 15 Dec 2009

Commentary

Mon 12 Oct 2009

Here’s 10 Principles of Economics, translated by The Stand Up Economist:

Wed 26 Aug 2009

Found something fascinating at Karl Denninger’s Market Ticker website:

That’s a clever little search in which I asked for the highest-volume stocks with prices over ten cents (to exclude the little penny pumper stocks on the OTC market.)

Well gee, let’s add this up!

That would be about 2.126 billion shares in total for these four stocks, two of which (Fannie and Freddie) are so far underwater in their equity value (to the government no less!) that there is no chance they’re worth anything, yet they remain listed, and the other two are zombie banks with Citibank existing only because of… [snip]

These four stocks represented thirty seven percent of all shares traded today.

Today 3,162 different stocks traded on the NYSE. These four represent 0.13% of the total, yet they comprised 37% of the volume. That’s an over-representation of nearly 300 times the average.

This follows well with the idea that we’re not getting any real, meaningful information out of the price action in the markets due to the low volume since May.

Tue 21 Jul 2009

A very good piece from The Globe and Mail, it’s an old interview with Niall Fergusen (from April) where he isn’t too optimistic about the length of the economic crisis.

The global crisis is far from over, has only just begun, and Canada is no exception, Mr. Ferguson said in an interview…

Policy makers and forecasters who see a recovery next year are probably lying to boost public confidence, he said. And the crisis will eventually provoke political conflict, albeit not on the scale of a world war, but violent all the same.

There will be blood, in the sense that a crisis of this magnitude is bound to increase political as well as economic [conflict]. It is bound to destabilize some countries.

And he concludes with this bit…

We just don’t have an improvement of standard of living of the sort we’re grown used to. And indeed if you have a more equitable redistribution through the tax system, which Obama is committed to, it might actually be no discernible downside for middle America and lower-class Americans. So many of the benefits of the boom went to the elites. If you have a lost decade plus redistribution, it may not be that dramatic a change for many, many people. People just have to get over the fact that their wealth wasn’t worth what they thought it was in 2006. Whether it’s their stock market portfolio or their housing. If we simply go back to where we were, in 2005, that’s surely not the worst thing that could happen to us.?

Also noteworthy is his comments about how much political power has been ceded back to congress from the executive branch. I guess that’s what happens when a legislator is elected to the presidency… he still has his legislative mentality.

Comments?

Tue 7 Jul 2009

Hilarious! From The King Report via Ritholtz (emphasis mine):

We are stunned ? no, we?re shocked, shocked over the following admission from an Assistant US Attorney about the theft of Goldman?s proprietary trading codes.

BN: At a court appearance July 4 in Manhattan, Assistant U.S. Attorney Joseph Facciponti told a federal judge that Aleynikov?s alleged theft poses a risk to U.S. markets. Aleynikov transferred the code, which is worth millions of dollars, to a computer server in Germany, and others may have had access to it, Facciponti said, adding that New York-based Goldman Sachs may be harmed if the software is disseminated.

?The bank has raised the possibility that there is a danger that somebody who knew how to use this program could use it to manipulate markets in unfair ways,? Facciponti said, according to a recording of the hearing made public today. [The prosecutor apparently does not understand the implications of his statement but most of The Street and much of the public do.] http://www.bloomberg.com/apps/news?pid=20601087&sid=ajIMch.ErnD4

Karl Denniger: Did Assistant US Attorney Facciponti make an erroneous statement, or did he just lay a nuclear egg on the table, step back, and set it off – on accident – admitting in open court that the software in question ?can be used to manipulate markets?? http://market-ticker.denninger.net/authors/2-Karl-Denninger

Zero Hedge: At least it is refreshing that none other than Goldman?s own de facto attorney admits that the firm has created a piece of code that permits ?market manipulation.?

Sat 4 Jul 2009

Nicholas Nassim Taleb catches flack from time to time for being a perma-bear. One of my friends even complains that he doesn’t think Taleb is worth listening to because we don’t know if he has made money off his views and predictions, specifically with the hedge fund where he is a principal.

I watched the video below, and it’s obvious to me that Taleb is not a trader, nor does he claim to be. What is he then? A philosopher of sorts, it is very clear he is interested most in being epistemologically honest.

In the video Taleb does make an interesting comment… if someone points to a house and says it is structurally unsound, does it matter if it falls down a minute later, or 10 years later? The house was unsafe.

He obviously takes the same idea with the economy or the markets — if it is unsafe, it doesn’t really matter if the market goes up at times… even for years at a time. That’s an idea that is antithetical to most traders, but traders don’t focus on the same things that philosophers do.

It’s also fun to watch the CNBC talking heads completely flummoxed and unsure how to even ask him questions.

Video via Ritholtz.

Sat 27 Jun 2009

Below you will find the internal sales tactic sheet for Lehman Brothers traders salespeople. The brokers would use these sheets when talking to a customer or prospect, and use the canned responses to try and persuade them to do more business with the firm.

Take a gander, and think about whether or not your are swayed by the emotions they try to evoke… The takeaway is that brokers are first and foremost salespeople.

Mon 15 Jun 2009

From the 5 Minute Forecast:

Sign of the times: Name the best-selling car in the United States. Nope, not the Toyota Camry, although that?s a good guess. No, in these recessionary times the crown goes to…

No bailout money was used in the production of this automobile.

Yes, it?s the Little Tikes Cozy Coupe, a venerable model introduced in 1979 ? earning itself a permanent spot recently at the Crawford Auto-Aviation Museum in Cleveland.

With an MSRP of around $60, the pedal-powered single-seater sold more than 457,000 units last year ? more than any model of the gasoline-powered variety. It?s American-made in Hudson, Ohio, and free of the taint of bailout money or White House-engineered bankruptcy proceedings that hosed secured creditors.

Mon 25 May 2009

A friend was nice enough to send me a blog posting about the USD no longer being the Russian Reserve Currency. Shocking stuff, surely, but let’s take a look at the cited MarketOracle.co.uk article…

The US dollar is not Russia?s basic reserve currency anymore. The euro-based share of reserve assets of Russia?s Central Bank increased to the level of 47.5 percent as of January 1, 2009 and exceeded the investments in dollar assets, which made up 41.5 percent, The Vedomosti newspaper wrote.

The dollar has thus lost the status of the basic reserve currency for the Russian Central Bank, the annual report, which the bank provided to the State Duma, said.

In accordance with the report, about 47.5 percent of the currency assets of the Russian Central Bank were based on the euro, whereas the dollar-based assets made up 41.5 percent as of the beginning of the current year. The situation was totally different at the beginning of the previous year: 47 percent of investments were made in US dollars, while the euro investments were evaluated at 42 percent.

The dollar share had increased to 49 percent and remained so as of October 1. The euro share made up 40 percent. The rest of investments were based on the British pound, the Japanese yen and the Swiss frank.

The report also said that the reserve currency assets of the Russian Central Bank were cut by $56.6 billion. The losses mostly occurred at the end of the year, when the Central Bank was forced to conduct massive interventions to curb the run of traders who rushed to buy up foreign currencies. The currency assets of the Central Bank had grown to $537.6 billion by October 2008. Therefore, the index dropped by almost $133 billion within the recent three months.

The majority of Russian companies, banks and most of the Russian population started to purchase enormous amounts of foreign currencies at the end of 2008. The dollar gained 16 percent and the euro 13.5 percent over the fourth quarter. The demand on the US dollar was extremely high, and the Central Bank was forced to spend a big part of its dollar assets, experts say.

There’s another way to read the Russian currency reserves situation…

The Russian central bank didn’t change it’s reserve ratios because of some macro analysis, they did so because of the domestic demand for foreign currencies (specifically the USD) and their intention to defend their currency.

Last October, Russia had US$500b in currency reserves (I’m rounding to make the math easier but less precise), 49% of it in USD ($245b) and 40% in EUR ($200b).

At the beginning of 2009, Russians started trying to buy foreign currencies, “The demand on the US dollar was extremely high.” To defend their currency, Russia removed funds from their currency reserve to meet the foreign currency demand and keep the ruble from collapsing.

Within the last several months, the Russian foreign currency reserves dropped by $133b. Let’s say 80% of the demand was for USD (“extremely high”). That would be $106b of the amount the reserves fell. Let’s say the other 20% is EUR, or $27b.

After transferring out $106b of USD, the Russian reserve would have $139b in USD. After transferring out $27b in EUR, they would have $173b in EUR. After these transactions, the new % split for the currency reserve would be 38% USD and 47% in EUR (relatively close to the percentages cited in the article, close enough for my loose arithmetic).

Instead of being proof of low demand for the USD, this article is actually evidence of incredibly high demand for the USD.

I think I’ve said it before… the USD is the worst currency in the world, except for all the others.

Sat 23 May 2009

Think that we’ve finally reached the bottom of the housing market?

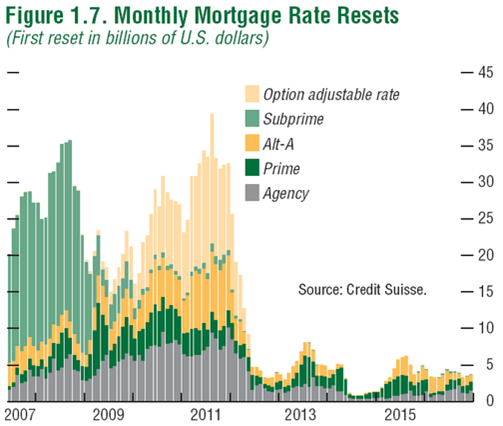

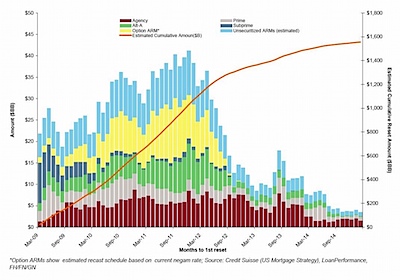

Let’s go back to how things looked in October 2007… we had a huge wave of subprime mortgages resetting, with a peak at about $35b (per month) in resets occurring in mid-2008. A majority of the resets were subprime.

And now the current situation, thanks to Calculated Risk:

Here we see another wave of resets coming, this time peaking at $40b in resets near the end of 2011. Subprime is a much smaller portion of the resets, but we still see between $20b and $25b of mortgages being reset every month through the rest of 2009 and 2010.

If mortgage rates stay low, this might not be a problem… but it doesn’t seem to me like we’re in the clear yet.