Thu 14 Sep 2006

I have to wonder whether the markets will continue to power ahead in the months ahead, or if instead that the steam is actually from a steamroller and we’re trying to pick up nickels (small profits) as it is barreling down.

[Note: the phrase “picking up nickels in front of a steamroller” is typically used to describe fixed income arbitrage, but I think it creates a nice metaphor in my current discussion.]

Let’s start with a little check in on history…

Today we have the S&P 500 and the Dow Jones Industrial Index both within spitting distance (if not closer) of their 52 week highs set back in May. So, if they can successfully break out above the recent highs, then we’re back in bull mode, right? The whole thing from May until now was just silly liltle correction?

Here is our wonderful S&P 500 Index from the last time that the Fed was hiking interest rates and paused. Yes, it was back in June 2000 when Mr. Greenspan paused his rate hikes at 6.5%. [And, yes, I’m cherry picking for the worst possible moment in the last 10 years for a bearish case… but it’s also the last time the Fed stopped hiking rates.]

Here’s the S&P in 2000 lined up with the S&P for this year (shifted so the calendar year starts at the same spot.

In 2000, the S&P had cleared its high of mid-July by a good couple of points, but then started what would turn out to be a fairly significant bear market. It tested its high, exceeded the July high by a couple of percent (it failed to exceed the March high) but still ended up paving the way for much lower prices.

I find it very interesting to look at the S&P over the calendar year 2000… it doesn’t look like the top of the market after a very long bull run. In fact, it looks completely like an indecisive market that was trying to figure out which way to go from here. Kinda similar to how this year’s market looks…

So, what helped the market decide which way to go back in 2000? The biggest culprit (in my opinion) was the tightening of credit and liquidity. Specifically, the rampant credit and liquidity expansion of the previous several years, finally changing trends to become constrictive enough to start the markets in a different direction.

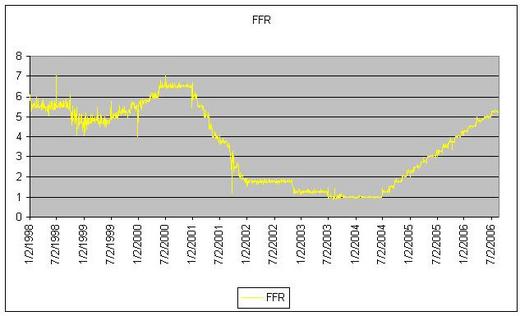

Here’s the Fed Funds rate since 1998. You can see the last rate hiking campaign ended in June 2000, at which point the Fed “paused” until January of 2001 when they started the trend downward.

Once again we find ourselves at or near the end of a Fed tightening cycle. The trend of the Fed Funds rates is still up, though in theory we’re in the middle of a “pause”. The main point though, is that the Fed is trying to create a less liquid environment… and a system with decreasing liquidity is the worst possible type for equities. Less liquidity feeds into market psychology and creates a major shift in market direction.

[Note: Liquidity is not the same thing as inflation nor expansion of the money supply…]

So, back the original question: Is it full steam ahead, or watch out for the steamroller? It sure looks like a steamroller to me.

I’m cautiously pessimistic, for a couple of reasons. The biggest is the Fed Funds rate, and what I consider at this point to be an inevitable US recession. Also contributing are increasing inflation and increasing inflation expectations, cyclically high corporate profits, high P/E ratios, and a myriad of other factors. Some of these have been present for a while, but it’s the current Fed backdrop that makes them so dangerous right now.

What is cautiously pessimistic? I’m definately not on the bull bandwagon… but I’m also not selling everything and going short the market with large positions. I am looking for opportunities to make bearish bets with favorable risk/reward ratios — where if I’m wrong I lose only a little money (or even make a little money), but if I’m right I make a lot of money.

Importantly, being cautiously pessimistic means that my biggest risk is one of opportunity cost. I don’t get to take part in the first portion of a potential bull continuation from here. When I compare that to the risk of being long with stops that could get overrun, I’m willing to make that tradeoff and take that risk. Which risk is right for you?