Tue 18 Dec 2007

It’s the time of year again for mutual funds to be disbursing their taxable income in the form of dividends… as we saw last year, some of the really good actively managed mutual funds have very large disbursements to make. The upside is that if you own these funds in a taxable account, they just gave you the funds needed to make your tax payments to the IRS.

If you were invested in the mutual fund for the whole year, you should have done well… but often these disbursements settle the taxable income from multi-year holdings, resulting in a tax hit for those who may have bought this year, but get to enjoy all the taxable events regardless of whether they owned when the mutual fund purchased the assets.

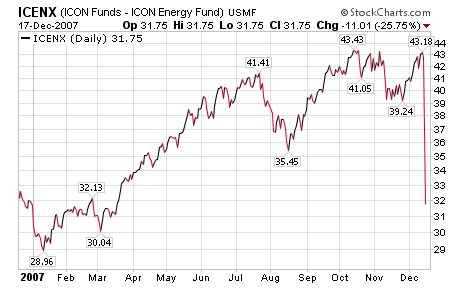

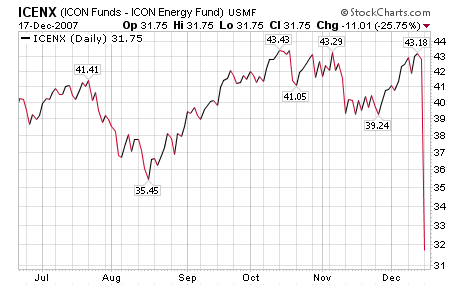

Here’s a shockingly too common chart ? ICENX is down 25% on its disbursement date (most likely 2% or so of the change is from daily changes in its holdings).

That means, if you bought in the last 6 months, you just inherited a tax burden that you didn’t “earn”.

While it’s great that the fund was able to earn 25%+ gains this year, this is an all-too-real problem for mutual fund investors. This is also one of the reasons why ETFs have gained so much in popularity… as the buyer and seller of an ETF, you get the benefit of determining when (and if) you incur a taxable event.