Tue 8 Jan 2008

John mentioned a little while ago an opinion that Growth was set to outperform for a while… I took it upon myself to follow up on this fact, and the results are quite impressive.

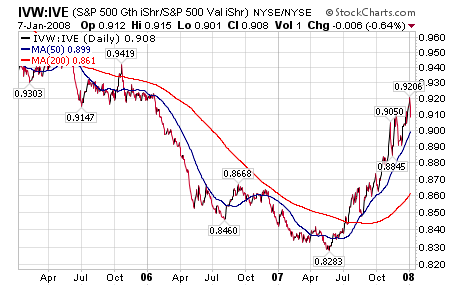

Comparing the Growth stocks in the S&P 500 against the Value stocks (as defined by the IVW = Growth and IVE = Value SPDR ETFs), Growth is in fact putting in an impressive performance (this is a 3 year view):

As the growth etf performs better than the value etf, the line rises. Since May of 2007, growth has been on a tear. As a form of kudos, John’s note about Growth outperforming was posted on May 14… right at the nadir on the above graph.

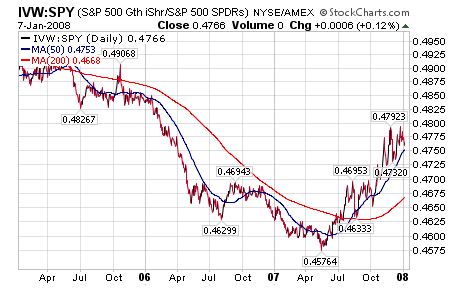

Likewise, Growth is outperforming the entire S&P 500:

While we’ve seen a few high-flying growth stocks take a beating recently during market dips (see GOOG, AAPL, etc.), these stocks as a group are actually doing quite well. During market declines, the outperformance would take the form of falling less in aggregate.