Wed 29 Oct 2008

I came across a particularly conspiratorial piece of analysis recently that claims that the following 4 statements (used at great length to justify various bailouts) are materially false.

- Bank lending to non-financial corporations and individuals has declined sharply.

- Interbank lending is essentially nonexistent.

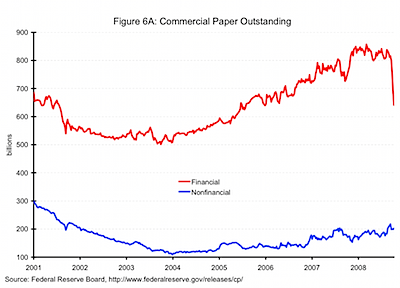

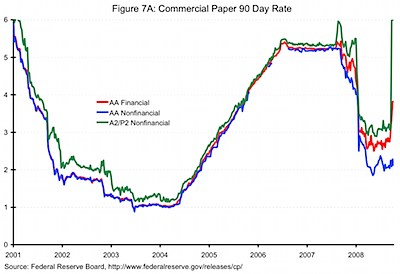

- Commercial paper issuance by non-financial corporations has declined sharply and rates have risen to unprecedented levels.

- Banks play a large role in channeling funds from savers to borrowers.

We’ve heard all 4 of these statements numerous times… and if I recall correctly, in sworn statements to Congress…

So, what kind of crazies wrote this paper? The Federal Reserve Bank of Minneapolis. Those f**ing nutjobs.

Note that the paper actually does say a crisis is happening, they just point out the fallacy of the layman’s explanation of what is happening…? The report is actually a quick read, and has some good charts to illustrate their analysis. Here are two of the charts that should provoke some thought…

Essentially, financial paper volume has dropped dramatically, but non-financial paper has not (and I’m not sure what the distinction is). And for the loans that are happening (the 2nd chart here) the rates are rising.

From the paper’s conclusion:

Our analysis has raised questions about the claims made for the mechanism whereby the ?nancial crisis is affecting the overall economy. We emphasize that we do not dispute that the United States is undergoing a ?nancial crisis and that the United States economy may be in a recession or may experience one in the near future. Our analysis is based on publicly available data. Policymakers have access to other sources of data as well. Policymakers could well believe that bold action is necessary based on data that are different from that considered here. If so, responsible policymaking requires that they share both the data and the analysis that underlies the need for bold policy with the public.

The report.? Found via Kedrosky.

November 14th, 2008 at 7:32 pm

There’s a good response here from… the Boston Federal Reserve.

http://www.fxstreet.com/news/forex-news/article.aspx?StoryId=d7155c1a-03df-47cc-b395-61a04f2759e1

January 25th, 2010 at 6:47 am

Your website looks really good. Being a blog writer myself, I really appreciate the time you took in writing this article.

January 25th, 2010 at 7:40 pm

Just want to say your article is striking. The clarity in your post is simply striking and i can take for granted you are an expert on this subject. Well with your permission allow me to grab your rss feed to keep up to date with forthcoming post. Thanks a million and please keep up the ac complished work. Excuse my poor English. English is not my mother tongue.