Mon 5 Mar 2007

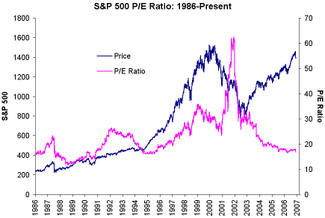

You may remember that I wrote about P/E compression a while back. Here’s a quick, updated view of the long-term P/E compression effect in the S&P 500 (brought to you by TickerSense):

While earnings have indeed been impressive, P/E ratios continue to grind lower. Even with earnings rising and prices going up, earnings have been rising faster than prices causing the ratio to fall.

The argument for a secular bear market (at least according to Unexpected Returns) is falling valuations, including the P/E ratio. Secular bear markets in the past have included falling or sideways stock markets, but the primary identifier is falling valuations, even if/while the economy and corporate earnings are strong.

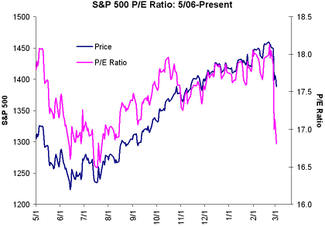

Here’s a zoom in to the last 10 months to see some of those squiggles a bit closer…

If we are in a secular bear market, we should see the P/E ratio continue to fall, whether from falling prices, or from Prices not rising as quickly as Earnings.