If you’re a hippy and are interested in lowering your carbon footprint, you might find an unexpected place to do so in the stock market and be able to profit at the same time… consider investing in timber. Both Rayonier (RYN) and Plum Creek Timber (PCL) are publicly traded companies that own significant timberland, and if logic holds, the timberland absorb enough carbon dioxide to offset your own personal production. (more…)

January 2007

Thu 25 Jan 2007

Wed 24 Jan 2007

Found over at Mish’s Global Economic Trend Analysis (about half-way down the page):

The Mortgage Lender Implode-O-Meter is reporting ?Twelve lenders have now gone caput since December 2006?. This number has has been increasing at a rate of 1-2 a week since December. Two of those lenders were among the top twenty subprime lenders. One of them was Ownit Mortgage, the other was Mortgage Lender Network. Ownit Mortgage and MLN both went bankrupt.

Mish wrote that post yesterday, and today the number is at 13.? Ouch.

Fri 19 Jan 2007

The British ONS (Office of National Statistics) has created and made public a Personal Inflation Calculator. As you would expect, it applies and compares the values you enter to the measured CPI in Great Britain, but it’s still pretty darn cool.

The ONS “is fighting back against accusations, fueled by newspaper campaigns, that its inflation index is inaccurate and underestimates the rate of inflation experienced by most people.”

Anyone want to take bets on how long it will take the BLS to create something like this too?

Thu 18 Jan 2007

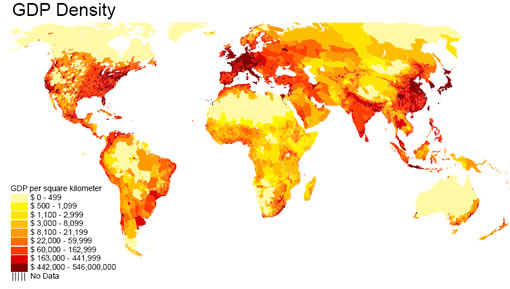

Oohh… pretty:

Read more about the world wealth density… and a few other random thoughts at Econobrowser.

Wed 17 Jan 2007

The figure was released in a study by McKinsey & Co. that maps financial assets around the globe and seeks to track the flows of these assets as they move from one region to another, putting hard numbers on the oceans of capital washing up around the globe.

Read more at BigPicture.

Tue 16 Jan 2007

Those crafty bookmakers over at TradeSports have decided to put the odds making to the probability of a US Recession in 2007… and here’s the result of the betting on their website:

Mon 15 Jan 2007

There is a list of 25 potential surprises for 2007 by Doug Kass at The Street.com. I actually like the summary version at The Big Picture as it’s briefer but still has the same amusing punch.

These are not intended to be predictions, but rather “events that have a reasonable chance of occurring, despite the general perception that the odds are very long.” (more…)

Wed 10 Jan 2007

A long time ago, John pointed me to the ETF Investing Guide.? It was originall published at Tech Uncovered before the author founded Seeking Alpha…? but the guide was preserved and is now hosted on the new site.

The ETF Investing Guide provides a sound argument for a simple asset allocation strategy using index ETFs.? It goes into detail on why you should avoid full-service brokers, index mutual funds, and other mainstream financial services.? Ditch all that, and manage your investments using index ETFs, take advantage of tax-loss selling, and enjoy the ride.

While I would argue with a few of the author’s points (e.g., staying away from all actively managed funds), it is a good guide for those who want a low-maintenance investment plan and are happy to earn average returns.

Mon 8 Jan 2007

We talked about the Currency Harvest Fund from PowerShares a while back, but PowerShares and Deutsche Bank are teaming up for even more interesting funds… Just launched:

PowerShares DB Energy Fund (DBE)

PowerShares DB Oil Fund (DBO)

PowerShares DB Precious Metals Fund (DBP)

PowerShares DB Gold Fund (DGL)

PowerShares DB Silver Fund (DBS)

PowerShares DB Base Metals Fund (DBB)

PowerShares DB Agriculture Fund (DBA)

These would be added to the DBV (Currency Harvest) and DBC (Commodity Select) funds that have been out for a while…

One would have to ask — why are they re-inventing the wheel? Why would they launch DBO (Oil) when the USO ETF has been out since mid-April? One good reason — USO has consistently underperformed the actual price of oil since the fund’s launch. The case is less clear when you look at the gold/silver and precious metals funds.

The real gem though is the DBA fund for Agriculture. The fund is splitting the investment evenly across Corn, Wheat, Soybean, and Sugar. This is the first chance for people to invest directly in these commodities without opening a futures account or trying to find a company that produces the commodity.

Sun 7 Jan 2007

I have mentioned the closed-end fund IGR before, and now is a good time to bring them up again… IGR is the “ING/Clarion Global Real Estate Income Fund”. While the full name is a mouth-full, it is quite a good fund, and a good fund to know about.

If you like REITs but think that the US based REITs are a bit overpriced or at least late in a bull cycle, you might want to consider diversifying some or all of your holdings into an internationally based fund like this. (more…)