April 2009

Monthly Archive

Wed 29 Apr 2009

Posted by Jason G. under

CommentaryNo Comments

I recently read George Friedman’s The Next 100 Years , and was quite impressed by the book… the author recently went on Tech Ticker, and linked below is a segment of his interview where he talks about the challenges China faces and why it won’t be the super-power that everyone else seems to expect.

Tech Ticker.

Good stuff, and definitely food for thought.

Mon 27 Apr 2009

Posted by Jason G. under

CommentaryNo Comments

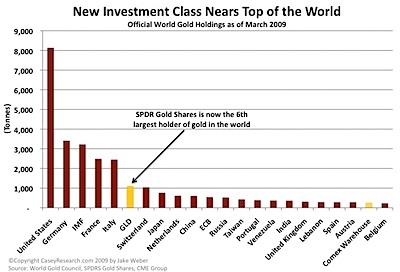

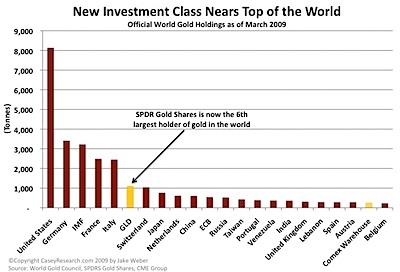

Who is now the 6th largest holder of gold in the world? The GLD ETF:

SPDR Gold Shares (GLD), an exchange-traded fund, first hit the market in November 2004 with 260,000 ounces of gold. Today, GLD is the world?s 6th largest holder of physical gold with over 35 million troy ounces in the vault.

Source.

Fri 24 Apr 2009

Posted by Jason G. under

CommentaryNo Comments

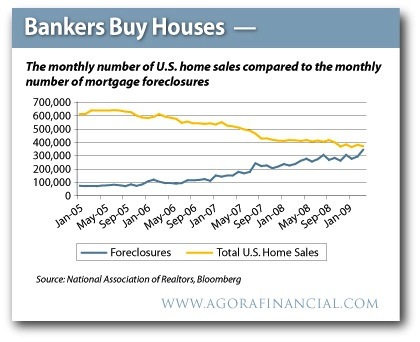

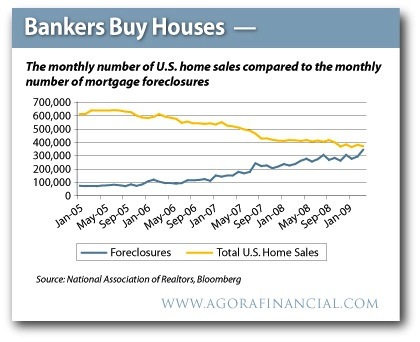

This is a little scary to see the number of sales and number of foreclosures on the same axis… and to see how close the numbers are to each other.

Source.

Wed 22 Apr 2009

Posted by Jason G. under

CommentaryNo Comments

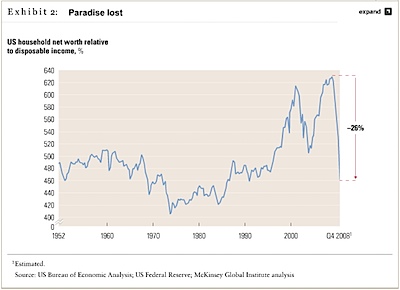

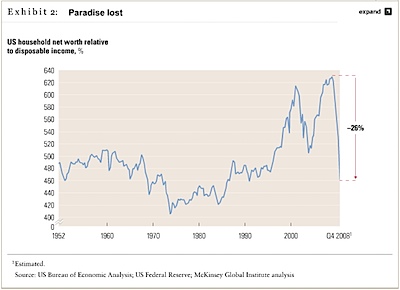

From McKensey, and interesting look at household net worth relative to disposable income.

So far the net worth has fallen a good deal more than in the 2001 bear market… the result being a decrease in consumption and an increased savings rate to make up for the losses.

Implicit in the chart is the fact that household net worths, in aggregate, fell about 160% of annualized disposable income. That means consumers would need to save every possible (discretionary) penny for the next year and a half to get back to the recent high.

Mon 20 Apr 2009

Posted by Jason G. under

CommentaryNo Comments

From the latest weekly musings of John Hussman:

The current bounce was fueled by a combination of deteriorating but ?less bad than expected? economic reports (therefore counting as ?upside surprises?), as well as what can only be considered misleading and semi-fraudulent earnings reports from distressed financial companies (the CEOs of these companies should be careful, because Bernie Ebbers is their poster child). Overall, the picture looks a lot like the bounce we observed in May 2001 (just before unemployment shot up and the market plunged again to fresh lows)…

As for the bank ?earnings? that we observed last week, it is worth repeating that operating earnings exclude what happens on the balance sheet. Moreover, we’ve seen some really fascinating accounting distortions in these numbers. Witness Goldman Sachs’ missing month of unreported losses. As the WSJ noted ? Goldman Sachs, for instance, announced earlier that it would change its fiscal year to end in December, unlike previous years when Goldman’s year-end was in November. The move effectively eliminated a very ugly month from Goldman’s official annual financial results for both 2008 and 2009.? As for Citigroup, the Journal reported Saturday that Citi’s $1.6 billion reported earnings benefited from ?a little-followed accounting adjustment under Financial Accounting Standards Board rule 159, which governs how banks value their debt? (note that this is separate from the FAS 157 ?mark-to-market? provision). The effect of the adjustment was to boost Citigroup’s earnings by $2.4 billion, because the value of its debt declined. So Citi reported earnings strictly because its bonds lost value. This would be funny if it was not so insidious.

Think about those last statements… Goldman Sachs made an entire month disappear, and Citigroup made an operating profit because it was able to lower the value of money it has borrowed from other people.

It takes a special kind of moral flexibility to run a big bank these days…

Mon 20 Apr 2009

Posted by Jason G. under

CommentaryNo Comments

From a recent email…

…a few more signs of the times: Could 2009 be the year of the ?survivalist?? Signs of this, from USA Today:

- Stockpiling. When the stock market drops, orders surge for freeze-dried food, survival kits and emergency supplies, says Nitro-Pak president Harry Weyandt. One best-seller: a $3,375 food reserve that feeds four people for three months

- Gardening. Sales of vegetable seeds and transplants are up 30% from 2008 at W. Atlee Burpee, the USA’s largest seed company. The National Gardening Association says 7 million more households will grow food this year than in 2008 — a 19% rise. A book on building root cellars is the top seller at Johnny’s Selected Seeds in Winslow, Maine, supervisor Joann Matuzas says

- Canning. Jarden Corp. says sales of its Ball and Kerr canning and preserving products are up more than 30% from 2008. Sonya Staffan, owner of The Jam and Jelly Lady commercial cannery in Lebanon, Ohio, is offering twice as many classes this year

- Sewing. More people are learning to sew so they can mend clothes and make home decor, says Rachel Cohen, spokeswoman for SVP Worldwide, owner of sewing products makers Singer and Husqvarna Viking

- Relocating. Steve Saltman, general manager of LandAndFarm.com, a national real estate company, says more customers want to ?live simply in a less-expensive place.? Jonathan Rawles of SurvivalRealty.com says more people moving to rural areas ?are specifically worried about economic and social instability.?

Sun 19 Apr 2009

Just a friendly reminder now that it’s past April 15… you are required by the IRS to keep your tax returns for 3 years from the filing date (April 15th of the next year or your actual filing date, whichever is later).

So if you don’t need to keep your tax returns for other reasons, you can safely shred or destroy your tax returns from tax year 2005 and earlier.

Fri 3 Apr 2009

Posted by Jason G. under

TradingNo Comments

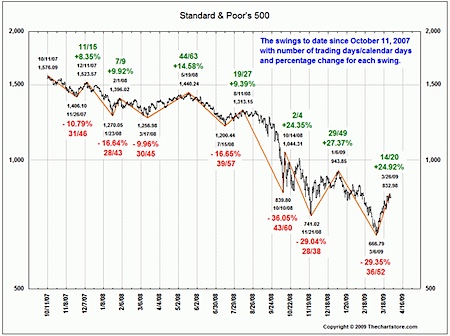

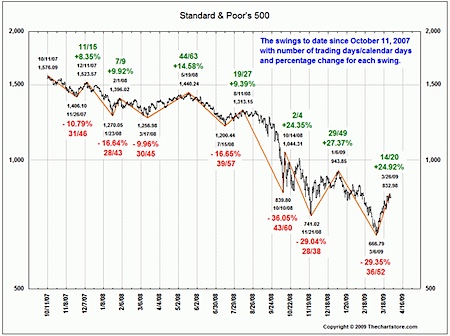

Fascinating overview chart of the S&P 500’s return, and the relative swings since Oct 2007.

From The Chart Store via Ritholtz.