April 2007

Monthly Archive

Thu 26 Apr 2007

Posted by Jason G. under

Research[3] Comments

It’s amazing to see the Dow above 13,000… an all-time high. But it’s interesting to realize what that means… what is really at an all-time high? The Dow is a price weighted index (read how splits and dividends are included if you really want to know), which means that not every component contributes the same amount to its ups and downs…

Different weighting is actually normal, but the Dow has an unusual weighting — it’s components are weighted based on price. That means that stocks with higher prices have a higher impact on the index (with some caveats — nothing is simple). In contrast, the S&P 500 is market-cap weighted, which can cause it’s own caveats and unusual behaviors…

A side effect of the price weighting is that (relatively) smaller companies like Boeing, 3M, and Caterpillar have a larger impact than larger companies like GE, Microsoft, and Pfizer. (more…)

Wed 25 Apr 2007

Posted by Jason G. under Uncategorized

No Comments

A friend recently suggested a new book by Monish Pabrai called The Dhando Investor. The literal translation of the word Dhando is “endeavors that create wealth.”

Mr. Pabrai has an interesting reputation as an aggressive value investor (not to be confused with the Aggressive Conservative Investor Marty Whitman) and could be one of the next generation of Warren Buffet-like investors.

You can see his profile and stock holdings at StockPickr, or at least as much of his stock holdings as outsiders can discern from required regulatory filings.

One of the more interesting points is his compensation structure. Unlike the typical hedge fund “2 and 20” (2% of assets plus 20% of profits), Pabrai takes no fee on assets managed, nor any fee on the first 6% of profits. However, he takes 25% of profits above 6%. The higher portion of the profits don’t improve his portion of the profits (compared to 20% of all profit) until he nets 30% profits in a given year.

According to StockPicker, his hedge fund (with $300 m under management) has returned an annualized 26% since 1999. Not too shabby.

Could this be the next Margin of Safety? Pabrai’s previous book is out of print and goes for $225…

Tue 24 Apr 2007

Posted by Jason G. under

CommentaryNo Comments

Here’s a fascinating note on accounting rules from a recent Hussman commentary:

…Following the Enron blow-up, the Financial Accounting Standards Board banned an accounting practice that Enron had used to book expected future profits as earnings, immediately, at very the moment it made an investment. In February of this year, the FASB effectively reversed itself in a rule that re-admitted the practice.

Perhaps not surprisingly, the buyout firm Blackstone Group has now filed for an initial public offering of shares. Blackstone is expected to apply the new accounting rule to immediately book the management and performance fees it expects to receive on long-term deals involving private companies, to which it may also apply its own fair value estimates. As the Wall Street Journal quoted Jack Ciesielski of the Accounting Analyst’s Observer, ?This is a black box if there ever was one.?

I wonder if I could do that when applying for a loan…? you know, claim all my income for the next three years of my job today so I can qualify for a bigger home mortgage…? brings a new meaning to the term liar loans, no?

Mon 23 Apr 2007

Posted by Jason G. under

CommentaryNo Comments

Here are the current streaks in the markets…

- S&P 500 up 12 of the 14 trading days in April

- Euro up 6 weeks in a row, up 11 of the last 12 weeks

- Gold up 7 weeks in a row, up 14 of the last 15 weeks

All of these are not typical trend moves, they are more typical of an exhaustion move before a turning point, or at the very least the signs of a maturing rally. And when we’re getting close to the May part of the catchphrase “sell in May and go away”, I’m starting to get a little risk averse. (more…)

Fri 20 Apr 2007

Posted by Jason G. under Uncategorized

No Comments

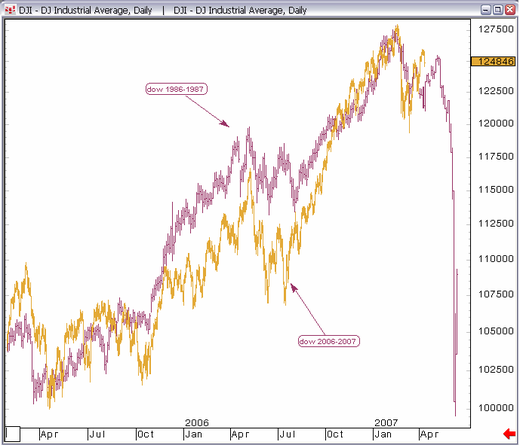

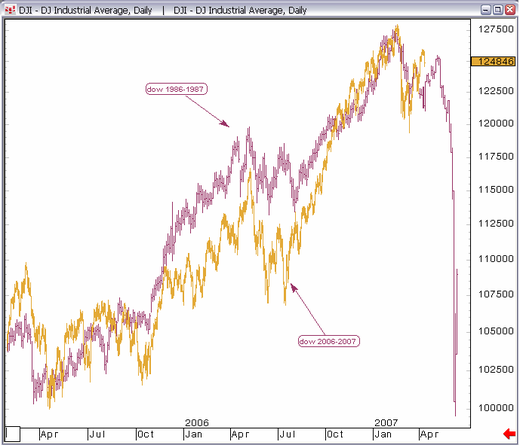

Though doing comparisons like this is specious, it is amusing how the two line up…

Here is a picture of the Dow Jones pre-1987 crash and the Dow Jones today.

Thu 19 Apr 2007

Posted by Jason G. under

CommentaryNo Comments Mon 16 Apr 2007

Posted by Jason G. under

Off TopicNo Comments

Here’s a lighter note from back in July 2002 at the bottom of the bear market:

If you had purchased $1,000 worth of “WorldCom” stock one year ago, it would now be worth US$10.59. If you had purchased US$1,000 worth of “Enron” stock one year ago, it would now be worth US$0.71. If you had purchased US$1,000 worth of “Budweiser” (the beer… not the stock) one year ago, drank all the beer, then traded in the cans at the redemption center, you would have US$107.

Given the current conditions of the market, drink heavily and recycle.

Sat 14 Apr 2007

Posted by Jason G. under

CommentaryNo Comments

The NY Times has a good calculator online that compares the cost of buying versus renting, and is worth playing with a bit…

Thu 12 Apr 2007

Posted by Jason G. under

CommentaryNo Comments

From Bloomberg:

Federal Reserve officials agreed last month that higher interest rates could still “prove necessary” even as they removed a reference in their policy statement to tighter credit.

And here’s the definition of jawboning:

…to attempt to influence or pressure by persuasion rather than by the exertion of force or one’s authority, as in urging voluntary compliance with economic guidelines…

If anyone still thinks that the Fed is trying to control inflation — they’re not.? They’re primarily interested in controlling inflation expectations.? Hence all the jawboning.

Thu 5 Apr 2007

Posted by Jason G. under

Off TopicNo Comments

Ever wonder what is going on with Ben Bernanke’s personal finances?? Slate took a look back before he was appointed the Fed Chair position.?? Bernanke’s net worth is between $1 and $5 million, and he owns only one common stock — shares of Altria/Phillip Morris.

Also amusing…? the personal financial profiles of Barack Obama, Harriet Miers, Chief Justice John Roberts, and plenty more I’m sure…

Next Page »