December 2008

Monthly Archive

Wed 31 Dec 2008

Posted by Jason G. under

CommentaryNo Comments

Amusing list from Dealbreaker, the Top 10 Reasons I Invested My Entire Fortune With Madoff:

1. But… he was self-administered! His costs for trading must have been so low!

2. Goldman did due diligence in 2001 [“no we didn’t”,“yes you did”] and they gave him a pass.

3. “C’mon… even if he does anything they will look the other way. He has friends on the inside!”

4. “I gave half to the preacher on television, and I gave half to the investment manager on television.”

5. “With all those parties, I figured he must be legit. You know… the Schwarzman rule.”

6. “I didn’t invest with Madoff. I invested with FGG. Their diligence process is serious business.”

7. “Screw FGG. Tremont is much more diligent.”

8. “You are both idiots. Pioneer Alternative has got my back.”

9. “He had the best Sharpe ratio in the whole world!”

10. “I said no comment. Oy vey.”

Pure Schadenfreude, but still amusing.

Sun 28 Dec 2008

Posted by Jason G. under

ResearchNo Comments

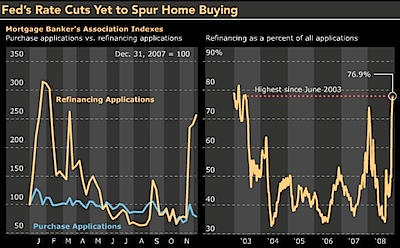

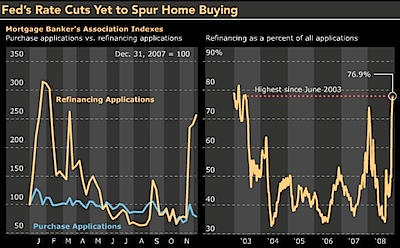

Here’s a chart from Bloomberg via The Big Picture.

It’s worth noting that with mortgage rates falling, more than a few people have taken the opportunity to (apply to) refinance their mortgage… That should certainly help banks as they are able to make fees on the refinancing, but doesn’t really bode well for sales of actual homes.

Sun 28 Dec 2008

Posted by Jason G. under

Off TopicNo Comments

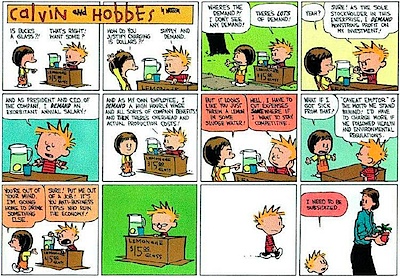

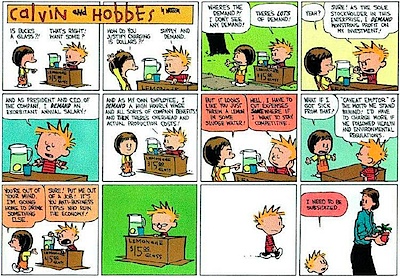

This is an old Calvin and Hobbes, but quite apropos given the current state of business and bailouts…

Source.

Wed 24 Dec 2008

Posted by Jason G. under

CommentaryNo Comments

I can always count on someone to take the geeky analytical ruler and apply it to anything, including the inflation present in the gifts described in the 12 days of Christmas. From Agora Financial’s 5 Min. Forecast:

If you were romantic fool enough to try to buy your true love all 78 gifts in the ?12 days of Christmas?? you?d be shelling out $21,080 this year ? an 8% increase over last.

Mostly, you can blame these fatties:

The cost of ?seven swans a swimming? leapt 33% to a whopping $5,600 in 2008.

The swan surge, says PNC, the bank responsible for this annual holiday cheer, is a matter of their seasonal availability. Factor out the price of swans and ?core? 12 Days prices are up a scant 1.1% from 2007.

The cost of three gifts actually fell: French hens dropped 33%; geese are down 30%; and the coveted ?5 golden rings? are 11% cheaper in light of uber-aggressive holiday discounts on luxury goods.

Tue 23 Dec 2008

Posted by Jason G. under

Commentary[2] Comments

It’s hard not to notice that Treasuries have taken to new heights. There were many comments about bonds being overpriced back when TLT was trading at 100, yet now it’s over 20% higher.

It’s worth turning to Hussman for some perspective. Here are some extracts from his recently weekly commentary.

…If the Fed ends up buying long-term Treasuries, it will almost certainly be a bad trade, but it may be required in order to absorb the supply from foreign holders set on dumping them.

And for good reason. The panic in the financial markets in recent months has driven Treasury bond prices to speculative extremes. Unfortunately, unlike the stock market, where hopes and dreams about future cash flows can often sustain speculative markets for years, it is very difficult to sustain speculative runs in bond prices. The stream of payments for bonds is fixed and known in advance. For foreign investors holding boatloads of U.S. Treasuries, the recent rally in the U.S. dollar, coupled with astoundingly low yields to maturity, have created a perfect time to get out.

In the next several months, we’re likely to observe one of two things. If the dollar holds steady, Treasury bond prices are likely to plunge; if Treasury prices hold steady, the value of the dollar is likely to plunge. Either way, foreign holders of Treasury securities are facing probable losses, and they know it.

Those of us interested in trading a fall in Treasuries can use TBT to get 2x the inverse return of long term treasuries. I’m waiting for a turn in price trend before jumping in.

Also worthy of noting is Hussman’s analysis of the foreclosure trends…

…I expected the second, third, and fourth quarters of 2008 to be the ?heavy hitters? in terms of foreclosures, with the foreclosure rate peaking between about November 2008 and January of 2009. I continue to believe that the foreclosure rate is currently near its peak, and will ease as we move through 2009. However, I also noted that a second spike of mortgage resets will occur the third quarter of 2010, which means that the foreclosure rate (and associated loan writedowns) will most probably pick up again in the first quarter of 2011.

We might well see some improvement in the foreclosure rates (improvement = less acceleration of the trend on the downside), so consider this fair warning so you’re not amongst those genuinely surprised.

Mon 22 Dec 2008

Posted by Jason G. under

Off TopicNo Comments

Here’s an amusing attempt to explain what is wrong with the bailout in story form…

Dad: “…The government is bailing out U.S. automakers because it doesn?t want to put a lot more folks out of work at a time when the unemployment rate is already soaring. And because the U.S. needs its domestic auto industry.?

Junior: ?Why? KB Toys is going out of business, and you and Mom still bought me toys for Christmas. I know I?m not supposed to know, but I peeked in Mom?s closet.?

From Caroline Baum via Bloomberg.

Thu 18 Dec 2008

Posted by Jason G. under

CommentaryNo Comments

According to FT, PwC, KPMG, and Ernst & Young were all involved in auditing the feeder funds which channelled money into accounts at Mr. Maddoff’s New York brokerage.

Thu 11 Dec 2008

Posted by Jason G. under

CommentaryNo Comments

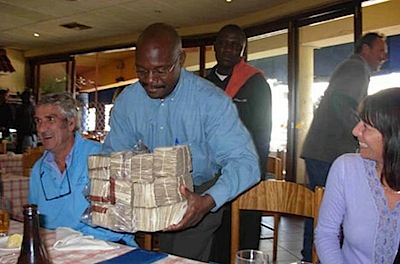

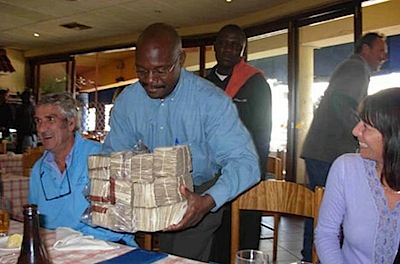

Here are a few stunning pictures of what currency destruction in Zimbabwe is all about…

The above picture is apparently someone planning to pay for their meal with bundles of Zimbabwe’s currency.

Wed 10 Dec 2008

Posted by Jason G. under

CommentaryNo Comments

Chrysler is trying to claim that “it’s not a bailout.” Their homepage:

This is obviously a PR move to gain sympathy with the financially illiterate, but quite frankly it is disappointing and a sign of how far gone things already are.

Mon 8 Dec 2008

Posted by Jason G. under

CommentaryNo Comments

Fascinating stuff… Reuters says:

Homeowners redefaulting after getting aid

More than half of mortgages modified in a bid to avoid foreclosure fell delinquent within six months, a top U.S. banking regulator said on Monday, casting doubt on a proposal to rewrite home loans en masse.

Comptroller of the Currency John Dugan said it was unclear why so many borrowers ran into trouble again so soon after getting help…

Are we going to need to bail out the people we’ve already bailed out?

Next Page »