July 2007

Monthly Archive

Tue 31 Jul 2007

Posted by Jason G. under

TradingNo Comments

I wanted to highlight a specific trade that I’ve been in, as well as some commentary to go along with it.

There has been much hullabaloo in the market press lately about the subrpime fallout. We’ve seen credit markets contract, lending standards shoot up, mortgage rates climb, etc. One of the principle instruments of this trend are the CDSs (Credit Default Swaps) and similarly abbreviated CDOs, CDLs, etc.

A while ago, I found a mutual fund that invests in the opposite side of the CDS market, and benefits if defaults or perception of default start to rise.

It trades under the symbol AFBIX with the long name, Access Flex Bear High Yield Fund. Here is a chart of the mutual fund’s price: (more…)

Sun 29 Jul 2007

Posted by Jason G. under

CommentaryNo Comments

Here are the numbers for this week:

- Dow Industrials – down 4.2%

- S&P 500 down 4.9%

- Russell 2000 down 7%, now in the red for the year

- REITs down 8.8%

The two day rout on Thursday and Friday were quite dramatic, but the declines are still in single-digits across the broad indexes. The panic and consternation are certainly overdone. Several headlines and commentary are acting like we just went through a full bear market, claiming that “stocks are so cheap now” or “where was the plunge protection team — surely we needed it this week!” I’m sorry, but if a 5% price dip makes a stock “cheap”, you don’t understand what the word cheap means and you have no sense of scale. (more…)

Fri 27 Jul 2007

Posted by Quicksilver under

Quant ,

Trading[3] Comments

Given that the big news is the big market down day (and, as I write, the aftershock), I figured it was the perfect time to try some of the concepts I learned in Why?Stock Markets Crash. Sornette provides a non-linear model formula that he attempts to fit to markets and notes that when this model finds a good fit, it often does so right before major crashes. This concept relates directly to talks of singularities. Basically, exponential growth, peppered with log-periodic (equally spaced on a log chart but closer and closer together on a standard chart)?waves, results in a singularity or critical time where a crash is highly likely.

There are several parameters that need to be optimized and, since it’s non-linear, it requires some major computation power. All those parameters make it more difficult because, during fitting, you happen upon local minima that?aren’t the real best minimum. So you have to run the optimization several times with different starting seed values and hopefully converge on the answer.

So enter Java. I wrote a program that would read in market data (S&P 500 since the ’03 bottom) and try to perform a fit to the model. (more…)

Sat 21 Jul 2007

Posted by Jason G. under

Off Topic1 Comment

If you really want to aggressively bet on a singularity approaching, you could do some pretty reckless things with the latest thing from Wall Street: life settlement backed securities.

From Business Week: Profiting From Mortality

Death bond is shorthand for a gentler term the industry prefers: life settlement-backed security. Whatever the name, it’s as macabre an investing concept as Wall Street has ever cooked up. Some 90 million Americans own life insurance, but many of them find the premiums too expensive; others would simply prefer to cash in early. “Life settlements” are arrangements that offer people the chance to sell their policies to investors, who keep paying the premiums until the sellers die and then collect the payout. For the investors it’s a ghoulish actuarial gamble: The quicker the death, the more profit is reaped.

Sun 15 Jul 2007

Posted by Quicksilver under

Discussion[2] Comments

I just finished reading Why Stock Markets Crash, a book that has been on my radar a while and I finally found it at the library of all places. Have you ever heard of this place? They have tons of books you can read for free! Anyway, the basic thesis of the book says that markets, while normally holding to effcient market theory, become highly predictable when herding behavior creates bubbles. These bubbles often take a shape that can be fit to a non-linear model of log-periodic oscillations that results in a critcal point in time or singularity. Ah, there’s that crazy, kooky word again!

Ever since I was?at university (that’s?Euro-trash for “in college”), I’ve been reading and pondering this concept of the singularity. I first heard of the idea in The Physics Of Immortality and later in The Singularity Is Near. If you’ve read any of these books, then you know what I mean by the Singularity and, if not, then basically it is a point at which greater-than-exponential growth leads to nearly vertical growth and a paradigm shift occurs that alters the system beyond recognition. (more…)

Fri 13 Jul 2007

Posted by Jason G. under

Off TopicNo Comments

I don’t want to have every post I write be about the subprime fallout and real estate…? fascinating though it may be.? So, in the interests of changing subjects, here is an old joke…

A guy who goes to his financial planner and says, “I want the best possible returns and I’m willing to take whatever risks are necessary.”

The financial planner says, “Great! I have just the ticket for you if you have the risk tolerance. The risks are high that you could lose everything, but it has the best possible return of anything you could put your money into. If it pays off, you would have a 3 billion percent return on the initial investment on average.? In some cases the numbers are much higher. ? This investment is the only place you’ll be able to find a 3 billion percent return with a holding period of less than a day…”

The customer is salivating at the mouth, waiting to hear the answer…

The answer: Take all your savings and buy lottery tickets for the next big jackpot drawing!? If you really don’t care about the risks (of losing 100% of the money “invested”), it does provide the best possible return compared to the $1 you pay for the winning ticket!

Thu 12 Jul 2007

There’s an excellent article titled “How professionals dump their toxic waste on you” by Paul Tustain that is worth reading. He starts with much of the current situation in subprime loans that we’ve talked about before… but then goes on to some additional interesting topics… below are some highlights.

Many investment funds (pension funds, bond funds, etc.) are holding CDS (credit default swap) portfolios as income generating bond-equivalent securities. The catch is that many of the CDSs are not actually insuring against default, but the other side of a speculative position that a risky borrower would default. The example cited was Delphi Corp’s recent fall from grace — when their debt was defaulted on, an astounding 10 times the amount of the debt was executed in the form of CDSs on their debt.

So these pension funds, hungry for bond-like returns, basically took the other side of a bet that Delphi would collapse. Not exactly investment grade, but thanks to financial alchemy, a pool of these CDSs were highly rated, and most likely offered to the buyers with leverage. (more…)

Wed 11 Jul 2007

Posted by Jason G. under

Research1 Comment

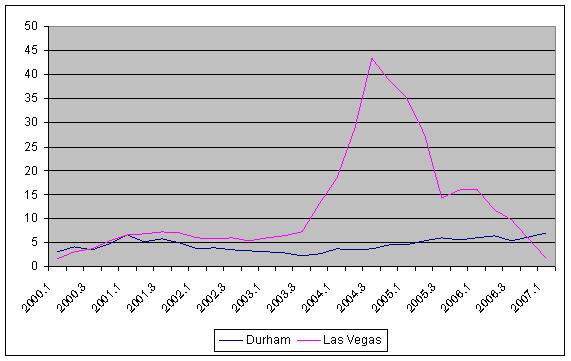

A few days ago I was asked how real estate was doing in Las Vegas…

Here’s the a chart from the government’s official house price appreciation (compared to Durham for kicks and giggles):

Within the metropolitan area of Las Vegas, there are approximately:

- 7,132 pre-foreclosure properties

- 2,457 properties up for auction

- 5,365 bank owned properties (e.g., the foreclosure occurred and now the bank owns the house/property)

Here are the same numbers for Raleigh. For comparison, Raleigh is about half the size of Las Vegas:

- 557 pre-foreclosure (15% as much as Las Vegas, adjusted for population)

- 7 auction (0.5%, adjusted for population)

- 562 bank owned (20%, adjusted for population)

And to add insult to injury, the average price of pre-foreclosure houses listed on RealtyTrac (where I looked this up) was approximately 2x or more in Las Vegas, despite only have a 20% higher cost of living…

There’s also an interesting ecological / health issue with pools attached to abandoned or underfunded properties… the stagnant standing water (if not property treated with chemicals) are a hotbed for mosquitoes and mosquito related program activities.

The Southern Nevada Health District, which includes pool-packed Las Vegas, relies on neighbors’ complaints to identify pools green with algae. By June 25, the district’s “green pool” count outpaced last year’s numbers by more than a fourth. Many involved vacant homes in the process of foreclosure, environmental health supervisor Mark Bergtholdt says.

(The pool/mosquito problem is also present in Southern California and Arizona where pools are common and foreclosures are unfortunately increasing.)

Sun 8 Jul 2007

Ok, so here’s another attempt at a discussion…? feel free to comment below or do your own post as a trackback to this one.

Almost all financial plans promote the concept of building a pool of “safe money” to cover emergencies and unexpected expenses.? This is certainly a good idea, though to think about it critically, we need to look at the real requirement behind the idea.? The idea isn’t just to have cash in a bank account, the point is to have immediate access to funds if/when you have unexpected situations crop up.

The traditional place for safe money would be a savings account or money market account.? Keeping this pool of money in such a safe place gives you many benefits — almost instant access, near zero chance of loss, etc.? You also have the benefit of knowing exactly how much you have available — maybe enough to cover expenses for 3 or 6 months were you to lose your job/income.

In many respects, you can consider your lines of credit (credit cards, home equity loans, etc.)? as part of your cash reserve.? You have nearly instant access to it — in some cases even quicker than getting money out of a money market account.? You have a near zero chance of losing the credit line — unless you sell your house (for HEL) or close your credit card account.? You also know how much you have available in the form of your credit limit (and your credit score can actually benefit from having a lot of unused credit available).? You can also potentially build a larger pool of safe money if you have good credit — in effect having a credit line that exceeds the same amount you can/would keep in cash.

So, allow me to posit a question — is there a real difference in keeping safe money in cash versus keeping the same amount in available credit?? (more…)

Fri 6 Jul 2007

Posted by Quicksilver under

Commentary ,

Quant1 Comment

I’ve read plenty of vitrol about the Sharpe Ratio (return divided by volatility) and how dangerous is can be and how insufficient it is as a measure of risk, but I’ve never been one to go all black & white about any piece of information. I find it hard to believe that something valuable can’t be gleaned from what it is saying to an investor, at least on a relative scale. My current experience with UP (Uberman’s Portfolio)?has brought it to my attention just how much of an uphill battle we often create for ourselves when we invest. Part of why UP has done well in recent times is that it’s a rare blend of high yields on reasonable volatility with very dynamic risk control capabilities such as low costs and small incremental lot size. In other words, the Sharpe Ratios in the forex world are historically high. The volatility of the markets, especially when diversified, is not a large multiple of the yields. (more…)

Next Page »