Fascinating chart from Casey Research… the Dow Industrials have their first ever negative quarterly earnings…

There are some other interesting details on the writeup.

Wed 27 Aug 2008

Fascinating chart from Casey Research… the Dow Industrials have their first ever negative quarterly earnings…

There are some other interesting details on the writeup.

Mon 25 Aug 2008

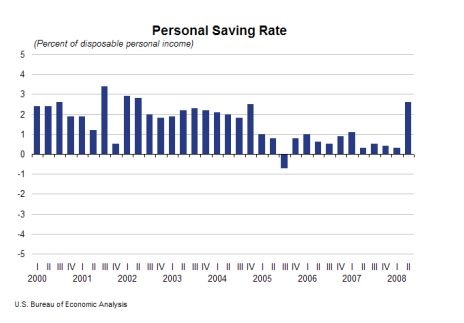

I thought this chart is worth sharing…

After dwindling to almost zero, the personal savings rate spiked up in the last measured period…

Fri 22 Aug 2008

On the demand front, both Silver and Zinc will likely get a boost in the future as new battery technology taps both for the next generation of laptop batteries. ZPower is promising higher energy density (to the tune of 40%), more environmental safety (yay recycling), and more chemical stability (a.k.a., fewer exploding laptop batteries).

No need to dive into silver or zinc futures to catch this trend though, the new batteries won’t be out until 2009, and existing laptops won’t be able to take advantage of the tech (new laptops that are designed to work with the new batteries only). That should stall things for a while, but if the 40% bump in energy payoff is real, I can’t imagine laptop makers not wanting a piece of this new tech.

Still, with Zinc in a downtrend since December 2006, this could eventually cause enough demand for a turn of the tide…

Silver is a different beast and tends to go along with Gold’s direction… and silver also provides the majority of the cost for said silver-zinc batteries.

Tue 12 Aug 2008

Here’s a bold prediction for you.. RealtyTrac will release their foreclosure report on Thursday, and I’m going to predict that the number of foreclosures will decline.

Alas, the prediction is not that bold… and the lower foreclosures is not a bullish phenomenon, but rather a result of the changing rules. California, as well as two other states are changing the minimum amount of time required before foreclosure hearings can begin. Lenders now have to wait a full 90 days from the first missed payment before they can begin foreclosure (it used to be 60 days).

Banking, and the banks’ potential losses from mortgages are still very far from transparent right now. The only way things look like they’re improving is if the numbers don’t reflect reality. We can expect more than a few people will point to the lower foreclosures as a reason “the bottom is in”, but I, for one, won’t be listening.

Edit 8/14 @ 10:00 AM: Oops, guess I was too optimistic.? “U.S. foreclosure activity in July increased 8 percent from the previous month and 55 percent from July 2007, according to the RealtyTrac Foreclosure Market Report released today.”? Even with the rule change, things sucked.

They do have pretty graphics though…

Tue 5 Aug 2008

Via The Big Picture’s guest post by Pleur de Plessis:

Richard Russell (Dow Theory Letters): Message to foreign creditors

?We owe our foreign creditors billions of dollars. Furthermore, our foreign creditors already own hundreds of billions of dollars. And our foreign creditors? big worry, among other worries is ? what happens if the dollar really tanks? Foreign holders of US dollars have already lost billions due to the slumping dollar. Yet, above all, the US needs our creditors holding on to their dollars and buying ever-more US bonds. What to do?

?Do you remember Treasury Secretary Paulson rushing all over the world ? Beijing, Moscow, Berlin, Tokyo ? you name it. What was he doing? I think he was beseeching our creditors, ?Look, you?ve got to help us and at the same time help yourself. Hold on to your US bonds, hold on to your Fannie and Freddie paper, keep buying our paper and our bonds. If you don?t, we?re all facing a catastrophe.

??The dollar on a purchasing power parity is ridiculously cheap now. And as soon as possible, we?ll raise rates and that will strengthen the dollar. In the mean time, we?ll talk the strong dollar. And we promise that we will not let the dollar hit the skids. A stronger dollar will help us and help you. Just hold our bonds, hold our paper, and keep buying our bonds. Furthermore, we?ll allow your Sovereign Wealth Funds to buy our assets. Buy all of the US you want. But rest assured, WE WILL DEFEND THE DOLLAR.?

?In my opinion, that was the deal. That was the reason why Paulson was running all over the world with his secret message.?

Source: Richard Russell, Dow Theory Letters, July 30, 2008.

This would argue for a sideways market in the USD, and an end to the continually falling dollar.

In my opinion, it may be a year or two, but the next big trend for the USD will likely be up. Will it be up because of US economic strength? Not really… but rather as the least bad of the global currencies. Europe is more messed up that most people realize (demographically), and they will have trouble maintaining the appearance of unity as the next few years unfold.

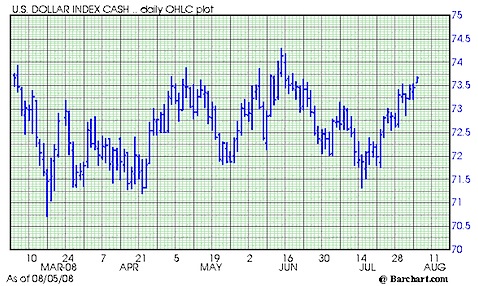

Here’s a side-note… take a look at the following chart of the USD index:

You might notice that the dollar has been rising and falling a lot over the last few months… as if constantly oscillating between extremes. This appearance is a side-effect of the way that charting software works… over the last day or two, the days from February have dropped off the left side of the chart, and the price range expanded to fit the entire graph…

To contrast, here is a 1 year chart where the price range shows a bit more vertical height.

The lesson? Be mindful of your chart axis.