October 2007

Monthly Archive

Wed 24 Oct 2007

Posted by Jason G. under

CommentaryNo Comments

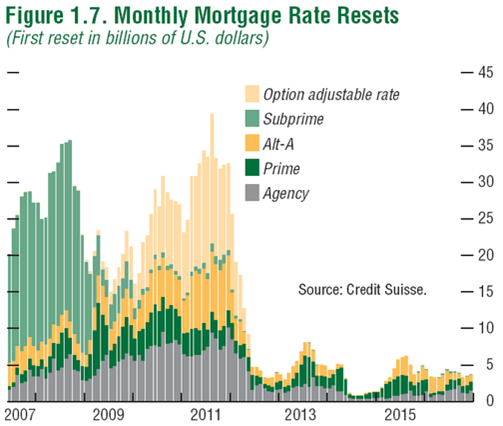

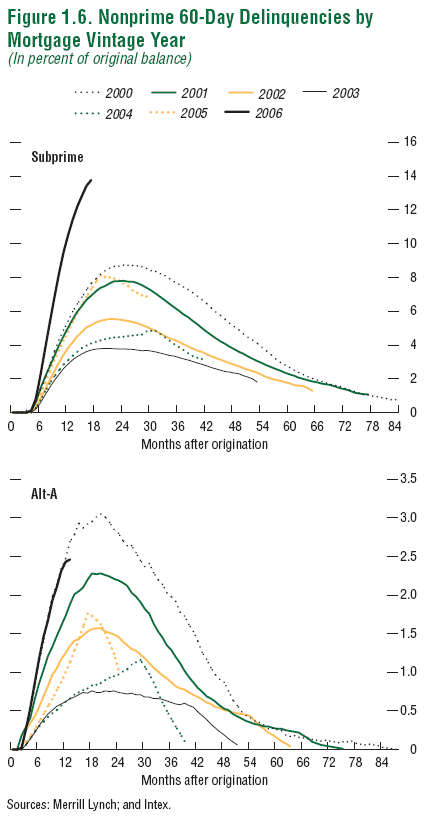

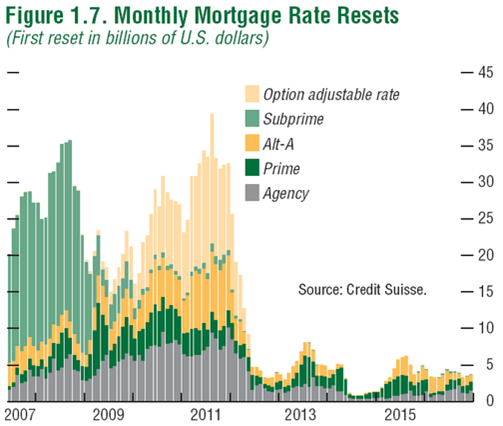

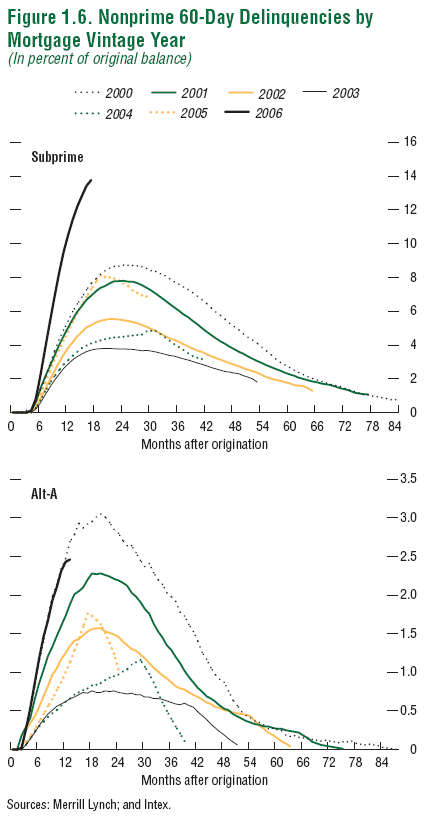

From over at The Big Picture, we have two interesting graphics that show the difficulty in the mortgage and housing markets.

The ongoing APR mortgage reset process isn’t expected to peak until some time in 2008. Following that, we see a new surge in resets, as Option Adjustable Mortgages begin to come up in 2010-11. Note that these are non-subprime mortgages.

Tue 23 Oct 2007

Posted by Jason G. under

Commentary[2] Comments

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…

Over the last week, we’ve seen what technicians would call a low-volume bounce. To the right is a segment of the chart of the last two weeks of the Dow 30. The biggest volume came on down days, and yesterday and today, both up days, had relatively low volume.

I’d want to see volume return on the up days before declaring the market in good health…

It’s also worth noting that the banking sector has been under-performing the rest of the market. John suggested recently that this might be a good leading indicator that the market still faces trouble, and I agree. This is another red flag for me…

What do you guys think? Is is time to be bullish due to the market’s ability to rally even with constant subprime fiascoes and credit market meltdowns? Or is this just a sucker’s rally?

Sun 21 Oct 2007

Posted by Jason G. under Uncategorized

1 Comment

After a big move on Friday, it can be good to check in with the first markets to open on Monday…? That would be the Nikkei, Shanghai and Aussie exchanges…

Bloomberg’s website typically has good international coverage.? Outside of US trading hours, they typically feature prices from Japan or Europe…

Yahoo Finance has a decent page that lists all the exchanges for Asia, the Americas, and Europe.? Obviously, Asia opens before the US markets, and Europe continues to trade after the US markets close.

So, how are these markets doing right now?? Badly.? The Nikkei is down over 3% to start the day (it is 11:30 am in Tokyo).? Not too surprising considering the shellacking that the US markets took on Friday…? We could see a bumpy start to the new week if that’s any indication.

Sat 6 Oct 2007

Posted by Quicksilver under

CommentaryNo Comments

Over on CXO Advisory, they talk about a recent study of hedge funds and what characteristics mark the good ones. The conclusion was:

In summary, hedge funds that conservatively smooth out market bumps with minimal net exposure to equities and mid-range returns tend to be the most reliable outperformers.

Translation: The hedge funds that actually hedge perform best. The modern hedge fund has become a catch-all for any type of investing, including all out Wild West directional plays. But those that actually attempt to have neutral market exposure plus some alpha rule the day. Brilliant!

Thu 4 Oct 2007

Posted by Jason G. under

Books[2] Comments

The Big Picture has another book excerpt available online, this one on psychology and investing, Richard Peterson’s Inside the Investor’s Brain: The Power of Mind Over Money.

The Big Picture has another book excerpt available online, this one on psychology and investing, Richard Peterson’s Inside the Investor’s Brain: The Power of Mind Over Money.

While I always cringe at statements like “happy people do X better”… The important point is that if you’re in a negative or distracted mood, it has a very real impact on your decision making process. You can still make good decisions when feeling negative, but the probability is lower, especially if you aren’t aware of the impact.

The excerpt is worth a quick read, and if you haven’t pondered much on the interaction between psychology and trading, this book should be a good read.

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…