January 2009

Monthly Archive

Sat 31 Jan 2009

Posted by Jason G. under

MacroNo Comments

There’s an old saying, “In the land of the blind, the one-eyed man is king.”

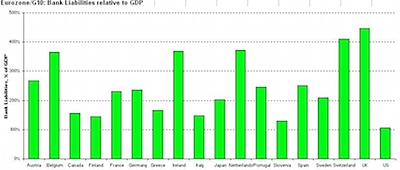

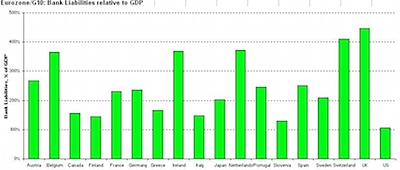

In global economies, the US situation looks horrible, until you compare it to everyone else. Below is the chart of bank liabilities relative to GDP.

In this case, we might say that in a world full of bankrupt economies, the slightly-insolvent economy is king.

Source.

Sun 25 Jan 2009

Posted by Jason G. under

TradingNo Comments

Apparently the CNBC Trading Contest is now over… Oddly enough, with my strategy of doing very little, I didn’t even notice that the contest finished up.

I’m quite impressed by my performance this year. My best portfolio ranked 5,673rd place at the end of the contest which put me in the top 1.1% of contestants with a cumulative gain of 73.6% since November 17 when the contest started (9 weeks).

Wow. If only I could boast about that type of return in my real trading accounts…

Here are the results broken out by portfolio:

- Shiny (gold stocks) : +73.6%

- Important (giants) : -8.4%

- Dividend : -11.8%

- Growth : +15.7%

- ou812 : +5.3%

Incidentally, over the same time period the S&P 500 returned -2.2%.

Obviously, my Shiny portfolio benefited from the sector the holdings were in (Gold Stocks) more than anything, and gold stocks returned around 69% over the same period.

If only the other 5672 people who finished in front of me would be disqualified so I could compete in the final trading round…

Sat 24 Jan 2009

Posted by Jason G. under

CommentaryNo Comments

There’s another good quarterly letter from GMO’s Jeremy Grantham. Here’s a choice quote about the illusions of wealth that our society just experienced.

During the market?s rise, I wrote about the fallacy of paper wealth, particularly as it applied to houses. At three times the price, they were obviously still the very same houses. How could we kid ourselves that we were suddenly rich and didn?t need to save for our pensions when we were sitting in the very same buildings we bought in 1974? With ?wealth? built on such false premises, it is not surprising that we come to grief from time to time. But the good news is that, as we move back down to earlier prices, they are still the same houses. We have not lost wealth, but just the illusion of wealth. Illusions tend not to have very long-lasting effects, but they obviously can and do have very powerful short- and even intermediate- term effects. This particular illusion, which applied to stocks, real estate, art, and almost everything else, was grand indeed, and it directly over-stimulated consumption and indirectly over-stimulated imports. In the process, it suppressed both savings and investments of our own locally generated income.

…it is worth remembering that real wealth lies not in debt but in educated people, laws, and work ethic, as well as in the quality and quantity of ?xed assets and the effectiveness of corporate organization.

He also argues that, as a ratio of debt-to-assets, we need to lower the total debt in the US economy by $10 to $15 trillion dollars. Some will happy by write-downs (about $1 trillion so far), some by allowing time to decrease the debt, and some by inflating away the value of the dollar.

Thu 22 Jan 2009

Posted by Jason G. under

Personal Finance1 Comment

I’m sure you’ve heard about the new nominee for Treasury Secretary, Timothy Geithner and his apparent IRS oversights… here are a few choice quotes from a WSJ op-ed:

Did Geithner have an incompetent accountant? Maybe. A Senate Finance Committee statement reports that he prepared his own returns for 2000, 2001, 2002 and 2005.

We’re tempted to say America needs a Treasury secretary who is smart enough to figure out his own taxes. But such a cheap shot would be beneath us. Instead, we are going to make a serious point: America needs a tax code simple enough for the Treasury secretary to figure out.

Then there’s this explanation of how the taxes got paid (or not):

The IRS audited Geithner in 2006 and discovered the problem for his 2003 and 2004 returns. Geithner paid just under $17,000 at the time, and the IRS waived any possible penalties.

So far, so good. But then there’s this: “A three-year statute of limitations had precluded the agency from auditing the 2001 and 2002 tax returns, a committee aide said.”

So, what can we learn from Geithner’s little tax trouble?

The guy is not as good at finances as he should be. But then again, apparently we don’t really care about our Treasury Department keeping the books straight, so maybe this isn’t such a big deal.

The other thing worth learning — the IRS is serious about it’s 3 year statute of limitations on audits. So, you really can shred all those old tax returns and forget about it… at least until you are nominated to a top-ranking position in the federal government.

~~

Note: The IRS actually has an exception to the 3 year rule for a “false or fraudulent” return. Unlike other tax law, the IRS actually has the burden of proving fraud before the fraud exception can be applied.

Wed 21 Jan 2009

Posted by Jason G. under

CommentaryNo Comments

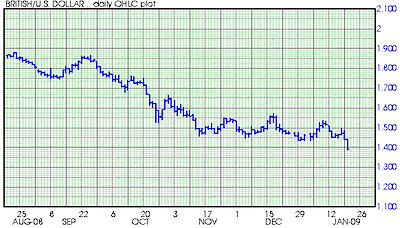

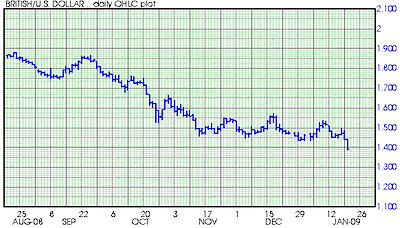

Here that giant crashing sound? That was the pound dropping to levels we haven’t seen in years… you can now exchange one US dollar for 1.4 pounds sterling. Only a year ago it was 1 dollar to 2 pounds…

Here’s a 3 year view:

Mon 12 Jan 2009

Posted by Jason G. under

MacroNo Comments

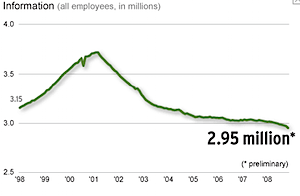

Check out this nice MSNBC feature for jobs by sector and unemployment rates by state. On the state unemployment, be sure to note the slider at the top that allows you to shift it by each month of 2008.

What is fascinating to me is the number of sectors that are not in a downtrend for the second half of 2008… Local, State, and Federal Governments, as well as Education and Health Services (Quasi-Government), and “Other” Services. I’m not impressed by the uptrend in “Natural Resources and mining” due to its very small size by comparison to the other sectors.

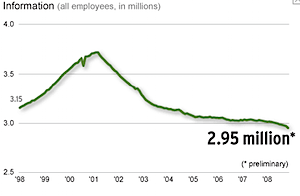

Also interesting, the “Information” sector, in which I believe we would fall, has been in a decline since 2001.

Sun 11 Jan 2009

Posted by Jason G. under

ResearchNo Comments

Let me get out my crystal ball and make some commodity price predictions about the next two or three weeks…

- Oil and Copper prices will rise

- Gold and Cattle Futures will fall

What makes me think that I can predict something like this?

FT Alphaville: Beware, commodity index rebalancing ahead

?The major commodity indices rebalance their respective asset weightings once a year (or occasionally more) – and with that comes a mass dose of buying and selling. The 2009 rebalancing is expected to start sometime this week.

Luckily, JP Morgan has produced its best guess of how the 2009 reweightings of the DJ AIGCI and the S&P GSCI indices will impact the market.

The weightings for both indices are released ahead of time, but begin to kick in the first few working days of the new year. In the case of the DJ-AIGCI – which JP Morgan estimates has $25 billion in funds tracking it – the new weightings come into force during the roll period that begins January 9. The S&P GSCI index weightings kick-in after its January roll which commences January 8. JP Morgan estimates about $50 billion of investment into that index.

JP Morgan see the most significant change coming in the DJ-AIGCI rebalance. Here the market weight of crude oil is expected to increase from 9.6% to 13.8%, gold from 10.8% to 7.9%, copper (COMEX) from 4.5% to 7.3%, live cattle from 6.4% to 4.3% and sugar from 4.7% to 3.0%. Meanwhile, S&P GSCI crude oil weight will go from 32% to 33.8%?.

Don’t be surprised if we see volatility kick up a notch from here…

Sun 11 Jan 2009

Posted by Jason G. under

CommentaryNo Comments

There is a persistent headline out there about “cash on the sidelines”. For a quick explanation of the argument, here is a quote from perma-bull Louis Navellier:

There’s more cash available to buy shares than at any time in almost two decades, a sign to some of the most successful investors that equities will rebound after the worst year for U.S. stocks since the Great Depression.

The $8.85 trillion held in cash, bank deposits and money- market funds is equal to 74 percent of the market value of U.S. companies, the highest ratio since 1990, according to Federal Reserve data compiled by Leuthold Group and Bloomberg.

…Still, the fact remains that stock prices are low and once a rally starts, there’s plenty of fuel to carry it for a long time.

The argument goes, as long as there is cash on the sidelines, that cash will be used to rush into the stock market propelling prices higher.

Let’s do a little thought experiment… Suppose I am one of those people with cash on the sidelines with $1000 in cash in my brokerage account. I decide to buy $1000 of INTC with my cash, giving someone $1000 for about 67 shares of INTC. The counter-party on the trade now has 67 fewer shares of stock, but also has a new $1000 in cash in his brokerage account.

The same thing happens in the other direction… When I sell the 67 shares of INTC, I get more cash in my brokerage account, but the person who bought the shares from me previously had the same amount of cash “on the sidelines” in his account.

Wait a minute, there’s still $1000 in “cash on the sidelines” just like before the stock got bought… but instead of being in my brokerage account, it’s now in that other guys… What gives?

The deal is that the amount of cash on the sidelines will always remain the same. The higher amount of cash on the sidelines right now is a byproduct of Fed easing and attempts to increase the money supply more than any money “leaving the market”.

The lesson here is obvious… the next time you hear someone arguing that the market has to go up because of the amount of cash on the sidelines one of two conclusions is possible: the person is uninformed, or they’re selling something. In the case of Mr. Navellier, I believe he’s guilty of both faults — he’s ignorant of the dynamics at work as well as trying to sell his long-only investment newsletter.

Sun 11 Jan 2009

Posted by Jason G. under

CommentaryNo Comments

Humorous…

Source.

Tue 6 Jan 2009

Posted by Jason G. under

CommentaryNo Comments

There’s an interesting op-ed piece from Bloomberg columnest Matthew Lynn where he makes a few predictions for 2009… one of the ones I enjoyed was this section:

Bust Culture

Five, the rise of frugality gurus: After the bling culture, we will need to get used to the bust culture. Television channels will clear all the real-estate shows from their schedules, replacing them with guides to growing your own vegetables. We will take pride in making our cars cover that second 100,000 miles. A new breed of frugality gurus will emerge out of the recession, dispensing tips on how to make the pennies go further. The best ones will make a fortune.

Anyone want to become a Frugality Guru?

Next Page »