Fascinating stuff from Barron’s…

But a less-noticed intrigue occurs on the date when Russell measures stock-market caps to determine index membership. It is May 29 this year. Working as a trader at Morgan Stanley some years back, Rosenthal noticed stocks that surged suspiciously up the ranks on the day Russell took its snapshot. “People actually forced stuff in…that is just evil,” says the finance prof. “It isn’t like you figured something out, but that you made it happen.”

Those suspicions seem borne out by the data of Zhan Onayev and Vladimir Zdorovtsov, researchers at State Street who studied the past nine years of Russell reconstitutions. Among the stocks that just squeaked above the Russell 2000 threshold, a disproportionate share of the gains for May occurred on that measurement date — in- deed, in the last minutes of that day.

…Last year, about 200 new additions made it over the Russell 2000 threshold, which was the market cap of the 3000th stock at the close of May 30, 2008-or $167 million. In this year’s still-recovering market, analysts like Citigroup’s Lori Calvasina predict the cutoff will be down around $72 million. A would-be manipulator might hoard illiquid stocks with market caps under that level, in hope of pushing them up on May 29.

The easy way to curtail this sort of stuff would be to take the average market cap over a period of time (say, 6 months) as criteria for inclusion…

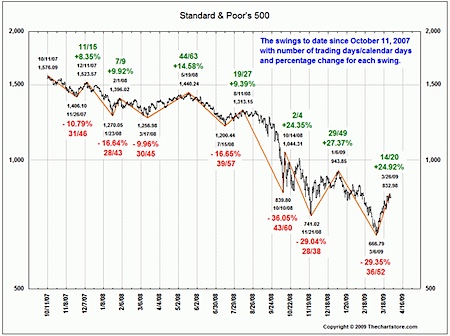

Kinda similar, Friday’s close was nothing short of spectacular. Karl Denninger has more over at his blog, but suffice it to say, a rather large order showed up in the futures for the SPX in the last minute (/ES is the S&P 500 e-mini futures contract). The total margin for the number of contracts pushed through was close to $22.5 million, with a dislocation that cost the order giver a whopping $1.25 million disadvantage for trying to push it through in the way they did.

I assume, and Dennninger agrees, that it was most likely a short position that got liquidated. But I think it raises more than a few eyebrows amongst those that are usually impervious to conspiracy theories…