I keep quoting John Hussman because he adds a fresh perspective to the headlines and news articles from other sources…

This is not to minimize the prospects for a further economic downturn, but to say that this is ?the worst economy since the Great Depression? is like blowing up a crate of dynamite on the Nevada Proving Grounds and saying it is the worst explosion since the detonation of the atomic bomb there. Even if the statement is accurate, the comparison is absurd.

Source

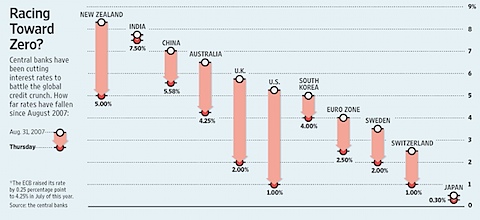

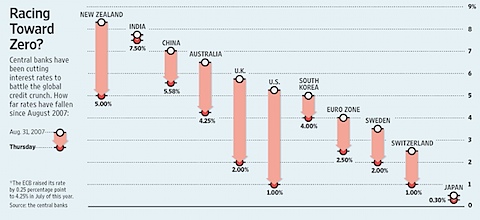

Nice graphic from WSJ on the central banking rate cuts:

I try to balance out my reading with both bullish and bearish commentary to keep a balanced perspective… a pursuit that is usually unsuccessful but still worthwhile.

I’m not horribly bearish or bullish in the short term as things stand today, but here’s the bearish side from 1440 Wall Street:

Do you considering slitting your wrists everytime Nouriel Roubini makes and appearance in the media? That don’t watch this interview with Nassim Nicholas Taleb.

…He does not like “medium risk” investments, because they probably are higher risk than you think.

But watch the video to catch his drift – he lays into the investment bankers/traders who created this mess, delving into how they often “cooked” their books and “gamed the metrics” to maximize compensation, while putting the whole system at risk.

Too many people had all the upside, with no downside. He explains the “asymmetry” and much more – great interview, if a bit depressing. And, for the time being, sell the rallies. The hedge fund deleveraging has more to go.

(video: 20 min)

As for my take on the current situation? I think stocks are a good value right now, based on the ratio of price to peak earnings (via Hussman). There’s a possibility for a big rally based on an overwhelmingly pessimistic public (bearish public and mainstream media = bullish contrary indicator), as well as a simple TFTF principle (TFTF = Too Far Too Fast)…

But I also think Nassim has a good point — I don’t know what is happening in the big hedge fund world, and it is entirely possible that another wave (or several waves) of hedge fund redemption have yet to run their course (as well as the potential waves of selling by would-be-retiring baby boomers). In addition to that, Nassim has been prophetic in the past about the risks we faced, and it would be foolish to dismiss his analysis completely without reasonable consideration.

With both sides in mind, things are cheap now, but there’s no reason that they won’t get a lot cheaper in the near future. Am I jumping in to go short the market on the next rally? No. Nor am I jumping in with both feet on the rallies. My current bias is slightly to the upside, but that can and likely will change as we see the price action unfold.

Bear markets do interesting things, one of which is to overreact severely on a few stocks. For example, there is a gold mining company that I have followed for a while by the name of New Gold Inc (NGD). Like every other gold stock out there, NGD has been shellacked to very low prices.

Interestingly, if we look at New Gold’s financials, the stock is currently trading with a market cap of $170m (at yesterday’s closing price of $0.80/share). The company currently has $250m in cash, and minimal amounts of debt. NGD is trading at a solid 30% discount to the cash on their balance sheet… so buy buying the shares at $0.80 you get $1.17 in cash, and they throw in several high quality, currently in production gold mines.

Of course, it’s not as clear cut as the previous sentence may make it sound… Rumors have it that New Gold is having some sort of issue with their new big mine, and thus they are not risk free. They’re also spending that cash to continue operations, as companies normally do, so the amount of cash on their balance sheet is not a constant, fixed amount.

Despite the caveats, this is a great bargain for a gold stock right now. And this certainly isn’t the only stock trading at a discount to cash…