So I’ve always had gripes about mediocre software… the latest is with Quicken 2008 and it’s constant flickering within the program. Intuit (the makers of Quicken) failed horribly with their GUI re-write, and it shows.

I actually contacted customer support at Intiut, and their responses were:

- Use less data — the more stuff you keep in quicken, the slower it runs

- Try downgrading your video driver

- Try turning down your video card’s hardware acceleration

I’m not making this up — these were their suggestions. To be fair, I tried all three suggestions. No improvement with the flicker, so I wrote back to them.

Here is their verbatim response:

Jason, regarding screen flickering we face the issue on 2007 and 2008, we are not sure when the issue will be resolved but the issue has already been notified to our concern department.

Jason, I hope you understand that this is an issue with the Product and there is nothing further I could have done to resolve this for you.

Wow, bad technical support, and a completely defeatist attitude. Bravo! If only I could create a $10 billion company and run it so poorly.

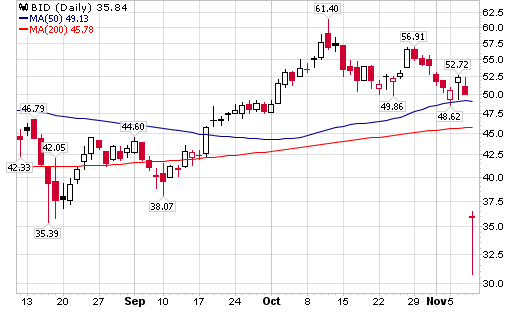

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…

After two up days, and plenty of celebration over Apple and similar tech profits it’s easy to think that Friday’s drop was just a single bad day, overdone because of option expiration and what not… But one thing to keep an eye on over the next few days is the volume on up or down days…