Back in my Econ classes, the professors laid out their version of the “proper” way to manage the Fed and the economy. Core to it was the concept of having orderly declines, rather than sharp, abrupt shocks to the system. In the 70s we had oil shocks, in 87 a single-day crash in the markets… If only (the academic argument proposed) the changes could be managed to be orderly, we would be better off as an economy.

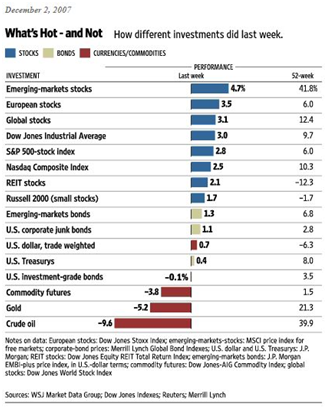

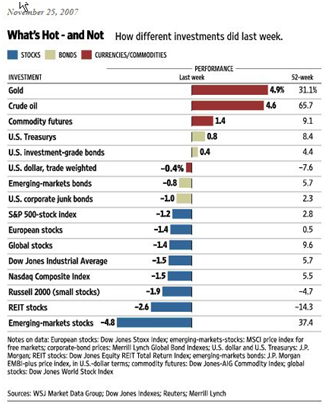

As we can see with the current environment, this academic concept seems to have graduated to the policy makers… whether it is an orderly decline in the dollar, or stalling tactics by the Fed to let the financial stocks have an orderly decline (super-SIV anyone?), or spinning the stock markets with well-timed announcements… the Fed and the Treasury are aiming at maintaining order despite problematic situations.

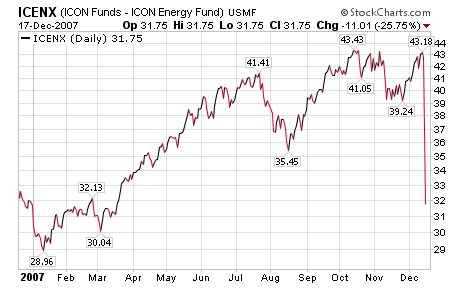

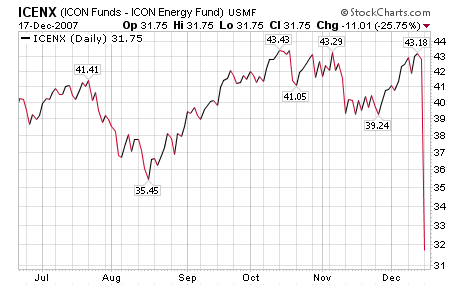

The side-effect of this managed order is a lot of volatility on a short trip. The S&P 500 looks like it will finish the year with a 3.6% gain, despite having a range of over 15% throughout the year (as measured by the distance from 52 week high to 52 week low).

So, is the economy in for a recession, and by implication, is the market preparing for a bear market? I’m not sure… though the arguments are strong in either direction. I think the following quote sums up the bullish posture for me.

Week after week we?ve heard reports about the dangers to housing along with the specter of hundreds of thousands of home defaults. On top of that, we?ve read about the massive losses to the leading banks brought on by the subprime mess. We?ve been warned of a potential collapse in the entire domestic and international banking system. We?ve heard that lending by the big banks had come to a virtual halt.

In the face of all this ghastly news, the November lows in the D-J Averages have held like a rock. Increasingly, it appears, the Averages have discounted the worst that can be seen ahead. As I write, both Averages are well above their November lows.

Naturally, stock market stability despite economic turmoil is not the final arbiter in our analysis of where the markets will head from here. Market efficiency is a process after all, and the markets may still be coming to grips with economic reality.

That said, I will be watching to see which way the prices break after volume returns in the new year.