Sun 29 Nov 2009

I’ve probably heard a hundred times that the stock market is a leading indicator for the economy.

Well, it is a leading indicator, except when it isn’t. Bob Hoye sheds some light on the topic:

For those whose dwell in GPD-Land, [the 2007 peak] is very important. At normal peaks, the cycle for stock certificates leads the peak in business activity by some 12 months. For example, the Dot-Com peak was in March 2000 and the NBER determined that it officially started in March of 2001.

The only times the peaks have been coincidental has been at the climax of a great financial mania.

For those who appreciate official numbers, in 1873 the crash began in mid September and the NBER determined that the recession started that October. In 1929, as everyone knows, the crash began in mid-September and the NBER date was set as that fateful August.

He goes on to point out a few interesting points…

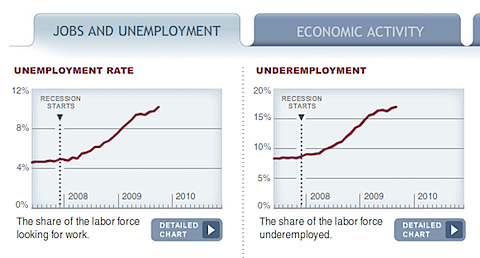

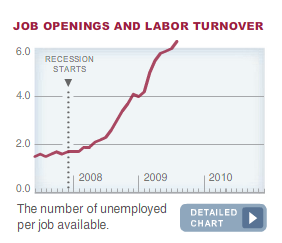

- In 1930 when the Secretary of Labor was on the “upswing”, unemployment was around 9 percent, as it is lately.

- Unemployment in the 30s did not reach 25% until 1933 — a full 4 years after the stock market peak