Mon 10 Jul 2006

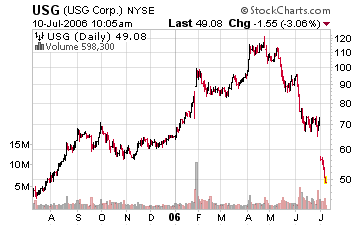

Thought I’d point you guys to a rather harrowing chart:

USG, the producer of wallboard materials and much more, has practically been in a free-fall the last few months. It was practically a rocket on the way up as it fought past a ton of negative asbestos litigation and is about to emerge from bankruptcy.

I typically wouldn’t care, but I recently sold USG because it hit my trailing stop (when it was at 95!). If you ever needed an argument for keeping trailing stops on individual stocks, just look back at this chart.

(USG is now so oversold it might be worth watching for a turnaround…)