Wed 21 Jan 2009

Commentary

Sun 11 Jan 2009

There is a persistent headline out there about “cash on the sidelines”. For a quick explanation of the argument, here is a quote from perma-bull Louis Navellier:

There’s more cash available to buy shares than at any time in almost two decades, a sign to some of the most successful investors that equities will rebound after the worst year for U.S. stocks since the Great Depression.

The $8.85 trillion held in cash, bank deposits and money- market funds is equal to 74 percent of the market value of U.S. companies, the highest ratio since 1990, according to Federal Reserve data compiled by Leuthold Group and Bloomberg.

…Still, the fact remains that stock prices are low and once a rally starts, there’s plenty of fuel to carry it for a long time.

The argument goes, as long as there is cash on the sidelines, that cash will be used to rush into the stock market propelling prices higher.

Let’s do a little thought experiment… Suppose I am one of those people with cash on the sidelines with $1000 in cash in my brokerage account. I decide to buy $1000 of INTC with my cash, giving someone $1000 for about 67 shares of INTC. The counter-party on the trade now has 67 fewer shares of stock, but also has a new $1000 in cash in his brokerage account.

The same thing happens in the other direction… When I sell the 67 shares of INTC, I get more cash in my brokerage account, but the person who bought the shares from me previously had the same amount of cash “on the sidelines” in his account.

Wait a minute, there’s still $1000 in “cash on the sidelines” just like before the stock got bought… but instead of being in my brokerage account, it’s now in that other guys… What gives?

The deal is that the amount of cash on the sidelines will always remain the same. The higher amount of cash on the sidelines right now is a byproduct of Fed easing and attempts to increase the money supply more than any money “leaving the market”.

The lesson here is obvious… the next time you hear someone arguing that the market has to go up because of the amount of cash on the sidelines one of two conclusions is possible: the person is uninformed, or they’re selling something. In the case of Mr. Navellier, I believe he’s guilty of both faults — he’s ignorant of the dynamics at work as well as trying to sell his long-only investment newsletter.

Sun 11 Jan 2009

Tue 6 Jan 2009

There’s an interesting op-ed piece from Bloomberg columnest Matthew Lynn where he makes a few predictions for 2009… one of the ones I enjoyed was this section:

Bust Culture

Five, the rise of frugality gurus: After the bling culture, we will need to get used to the bust culture. Television channels will clear all the real-estate shows from their schedules, replacing them with guides to growing your own vegetables. We will take pride in making our cars cover that second 100,000 miles. A new breed of frugality gurus will emerge out of the recession, dispensing tips on how to make the pennies go further. The best ones will make a fortune.

Anyone want to become a Frugality Guru?

Thu 1 Jan 2009

Paul Wilmott is a pretty big name amongst Quants, and it is amusing to read his blog. He recently wrote a little blurb on economic models, and the economists who should give back their Nobel Prizes… The problem is economists who trick themselves into the mistake of adding complexity to a model in the theory that it improves accuracy…

We don?t need more complex economics models. Nor do we need that fourteenth stochastic variable in finance. We need simplicity and robustness. We need to accept that the models of human behaviour will never be perfect. We need to accept all that, and then build in a nice safety margin in our forecasts, prices and measures of risk.

Wed 31 Dec 2008

Top 10: Reasons I Invested My Entire Fortune With Madoff

Posted by Jason G. under CommentaryNo Comments

Amusing list from Dealbreaker, the Top 10 Reasons I Invested My Entire Fortune With Madoff:

1. But… he was self-administered! His costs for trading must have been so low!

2. Goldman did due diligence in 2001 [“no we didn’t”,“yes you did”] and they gave him a pass.

3. “C’mon… even if he does anything they will look the other way. He has friends on the inside!”

4. “I gave half to the preacher on television, and I gave half to the investment manager on television.”

5. “With all those parties, I figured he must be legit. You know… the Schwarzman rule.”

6. “I didn’t invest with Madoff. I invested with FGG. Their diligence process is serious business.”

7. “Screw FGG. Tremont is much more diligent.”

8. “You are both idiots. Pioneer Alternative has got my back.”

9. “He had the best Sharpe ratio in the whole world!”

10. “I said no comment. Oy vey.”

Pure Schadenfreude, but still amusing.

Wed 24 Dec 2008

I can always count on someone to take the geeky analytical ruler and apply it to anything, including the inflation present in the gifts described in the 12 days of Christmas. From Agora Financial’s 5 Min. Forecast:

If you were romantic fool enough to try to buy your true love all 78 gifts in the ?12 days of Christmas?? you?d be shelling out $21,080 this year ? an 8% increase over last.

Mostly, you can blame these fatties:

The cost of ?seven swans a swimming? leapt 33% to a whopping $5,600 in 2008.

The swan surge, says PNC, the bank responsible for this annual holiday cheer, is a matter of their seasonal availability. Factor out the price of swans and ?core? 12 Days prices are up a scant 1.1% from 2007.

The cost of three gifts actually fell: French hens dropped 33%; geese are down 30%; and the coveted ?5 golden rings? are 11% cheaper in light of uber-aggressive holiday discounts on luxury goods.

Tue 23 Dec 2008

It’s hard not to notice that Treasuries have taken to new heights. There were many comments about bonds being overpriced back when TLT was trading at 100, yet now it’s over 20% higher.

It’s worth turning to Hussman for some perspective. Here are some extracts from his recently weekly commentary.

…If the Fed ends up buying long-term Treasuries, it will almost certainly be a bad trade, but it may be required in order to absorb the supply from foreign holders set on dumping them.

And for good reason. The panic in the financial markets in recent months has driven Treasury bond prices to speculative extremes. Unfortunately, unlike the stock market, where hopes and dreams about future cash flows can often sustain speculative markets for years, it is very difficult to sustain speculative runs in bond prices. The stream of payments for bonds is fixed and known in advance. For foreign investors holding boatloads of U.S. Treasuries, the recent rally in the U.S. dollar, coupled with astoundingly low yields to maturity, have created a perfect time to get out.

In the next several months, we’re likely to observe one of two things. If the dollar holds steady, Treasury bond prices are likely to plunge; if Treasury prices hold steady, the value of the dollar is likely to plunge. Either way, foreign holders of Treasury securities are facing probable losses, and they know it.

Those of us interested in trading a fall in Treasuries can use TBT to get 2x the inverse return of long term treasuries. I’m waiting for a turn in price trend before jumping in.

Also worthy of noting is Hussman’s analysis of the foreclosure trends…

…I expected the second, third, and fourth quarters of 2008 to be the ?heavy hitters? in terms of foreclosures, with the foreclosure rate peaking between about November 2008 and January of 2009. I continue to believe that the foreclosure rate is currently near its peak, and will ease as we move through 2009. However, I also noted that a second spike of mortgage resets will occur the third quarter of 2010, which means that the foreclosure rate (and associated loan writedowns) will most probably pick up again in the first quarter of 2011.

We might well see some improvement in the foreclosure rates (improvement = less acceleration of the trend on the downside), so consider this fair warning so you’re not amongst those genuinely surprised.

Thu 18 Dec 2008

According to FT, PwC, KPMG, and Ernst & Young were all involved in auditing the feeder funds which channelled money into accounts at Mr. Maddoff’s New York brokerage.

Thu 11 Dec 2008

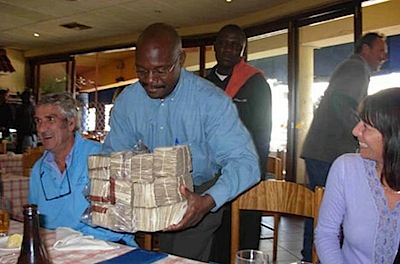

Here are a few stunning pictures of what currency destruction in Zimbabwe is all about…

The above picture is apparently someone planning to pay for their meal with bundles of Zimbabwe’s currency.