Mon 5 Jan 2009

This is a good article by John Hussman about portfolio rebalancing and matching your timeframe to your portfolio’s duration. If your primary tool for investment tweaking is asset allocation, it is very good to give you an extra dimension from what you probably already know well.

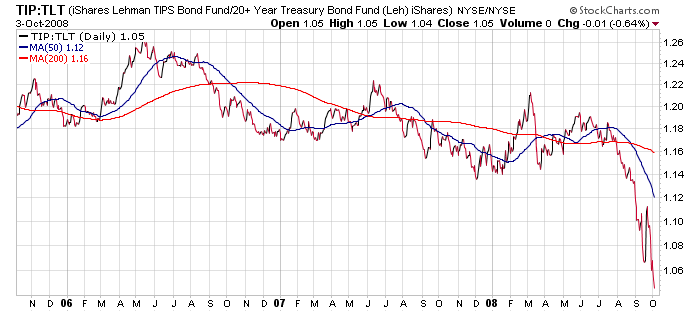

With the recent surge in Treasury bond prices, the effective duration of a 30-year Treasury bond has climbed from just over 16 years to nearly 20 years. Meanwhile, the plunge in the stock market has collapsed the duration of the S&P 500 from nearly 60 years to just about 30 today.

For investors who rebalance their portfolios annually, this is essential information. Given the probable long-term returns that stocks and Treasury bonds are priced to deliver, an investor seeking a 7% long-term total return would currently require an allocation of about 60% in stocks and 17% in bonds, for an overall portfolio duration of about 21 years ? only a third of the duration that an investor seeking that same long-term return would have had to accept just 15 months ago! Given the poor long-term returns that Treasury bonds are priced to deliver, an investor with any view at all about market direction would likely forego the 17% allocation to long-term bonds, opting for shorter-duration (and only slightly lower yielding) securities until the Treasury market normalizes.