A few days ago I was asked how real estate was doing in Las Vegas…

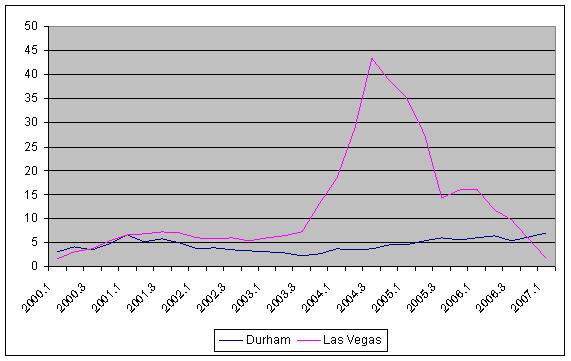

Here’s the a chart from the government’s official house price appreciation (compared to Durham for kicks and giggles):

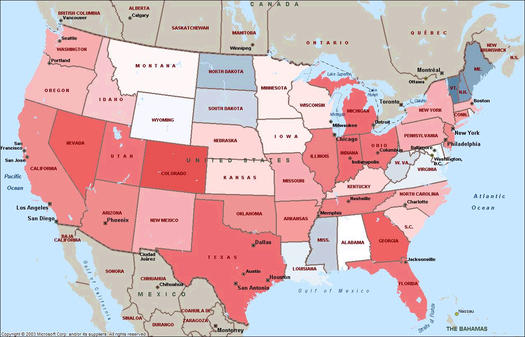

Within the metropolitan area of Las Vegas, there are approximately:

- 7,132 pre-foreclosure properties

- 2,457 properties up for auction

- 5,365 bank owned properties (e.g., the foreclosure occurred and now the bank owns the house/property)

Here are the same numbers for Raleigh. For comparison, Raleigh is about half the size of Las Vegas:

- 557 pre-foreclosure (15% as much as Las Vegas, adjusted for population)

- 7 auction (0.5%, adjusted for population)

- 562 bank owned (20%, adjusted for population)

And to add insult to injury, the average price of pre-foreclosure houses listed on RealtyTrac (where I looked this up) was approximately 2x or more in Las Vegas, despite only have a 20% higher cost of living…

There’s also an interesting ecological / health issue with pools attached to abandoned or underfunded properties… the stagnant standing water (if not property treated with chemicals) are a hotbed for mosquitoes and mosquito related program activities.

The Southern Nevada Health District, which includes pool-packed Las Vegas, relies on neighbors’ complaints to identify pools green with algae. By June 25, the district’s “green pool” count outpaced last year’s numbers by more than a fourth. Many involved vacant homes in the process of foreclosure, environmental health supervisor Mark Bergtholdt says.

(The pool/mosquito problem is also present in Southern California and Arizona where pools are common and foreclosures are unfortunately increasing.)