Fri 1 Jun 2007

Wed 30 May 2007

The big news this morning is the change in tax rules for trading in China.? Officials are trying to get the recent rampant speculation under control (the SSEC is up 186% in the last 12 months) .? The Shanhai composite traded down 6.5% overnight.

The 6.5% is barely a blip so far in the parabolic curve of the market, but this could start to shake things up…

The big drop on Feb. 27 was preceded by a similar change in legal regulations in China, but it doesn’t look like western markets are too worried about today’s change — pre-market futures are down around 0.5% for US markets.

Sun 27 May 2007

You may have heard the old saying: a recession is when your neighbor loses his job, a depression is when you lose your job.

Bad news, the mortgage loan debacle is no longer happening to other people… my bank has been hit by it and may be about to go out of business.

Not to worry, their retail accounts are being sold to Everbank. The changes are primarily bad for investors, not for account holders. The accounts are FDIC insured, though I’m sure it would have sucked to have to collect on the insurance if someone like Everbank hadn’t stepped up to buy the accounts.

Mon 7 May 2007

In April, the S&P 500 went up 4.3%. If it were to continue at the same pace every month, in a year it would be up over 50%.

Anyone want to bet whether this type of rise is sustainable?

Thu 26 Apr 2007

It’s amazing to see the Dow above 13,000… an all-time high. But it’s interesting to realize what that means… what is really at an all-time high? The Dow is a price weighted index (read how splits and dividends are included if you really want to know), which means that not every component contributes the same amount to its ups and downs…

Different weighting is actually normal, but the Dow has an unusual weighting — it’s components are weighted based on price. That means that stocks with higher prices have a higher impact on the index (with some caveats — nothing is simple). In contrast, the S&P 500 is market-cap weighted, which can cause it’s own caveats and unusual behaviors…

A side effect of the price weighting is that (relatively) smaller companies like Boeing, 3M, and Caterpillar have a larger impact than larger companies like GE, Microsoft, and Pfizer. (more…)

Wed 25 Apr 2007

A friend recently suggested a new book by Monish Pabrai called The Dhando Investor. The literal translation of the word Dhando is “endeavors that create wealth.”

Mr. Pabrai has an interesting reputation as an aggressive value investor (not to be confused with the Aggressive Conservative Investor Marty Whitman) and could be one of the next generation of Warren Buffet-like investors.

You can see his profile and stock holdings at StockPickr, or at least as much of his stock holdings as outsiders can discern from required regulatory filings.

One of the more interesting points is his compensation structure. Unlike the typical hedge fund “2 and 20” (2% of assets plus 20% of profits), Pabrai takes no fee on assets managed, nor any fee on the first 6% of profits. However, he takes 25% of profits above 6%. The higher portion of the profits don’t improve his portion of the profits (compared to 20% of all profit) until he nets 30% profits in a given year.

According to StockPicker, his hedge fund (with $300 m under management) has returned an annualized 26% since 1999. Not too shabby.

Could this be the next Margin of Safety? Pabrai’s previous book is out of print and goes for $225…

Tue 24 Apr 2007

Here’s a fascinating note on accounting rules from a recent Hussman commentary:

…Following the Enron blow-up, the Financial Accounting Standards Board banned an accounting practice that Enron had used to book expected future profits as earnings, immediately, at very the moment it made an investment. In February of this year, the FASB effectively reversed itself in a rule that re-admitted the practice.

Perhaps not surprisingly, the buyout firm Blackstone Group has now filed for an initial public offering of shares. Blackstone is expected to apply the new accounting rule to immediately book the management and performance fees it expects to receive on long-term deals involving private companies, to which it may also apply its own fair value estimates. As the Wall Street Journal quoted Jack Ciesielski of the Accounting Analyst’s Observer, ?This is a black box if there ever was one.?

I wonder if I could do that when applying for a loan…? you know, claim all my income for the next three years of my job today so I can qualify for a bigger home mortgage…? brings a new meaning to the term liar loans, no?

Mon 23 Apr 2007

Here are the current streaks in the markets…

- S&P 500 up 12 of the 14 trading days in April

- Euro up 6 weeks in a row, up 11 of the last 12 weeks

- Gold up 7 weeks in a row, up 14 of the last 15 weeks

All of these are not typical trend moves, they are more typical of an exhaustion move before a turning point, or at the very least the signs of a maturing rally. And when we’re getting close to the May part of the catchphrase “sell in May and go away”, I’m starting to get a little risk averse. (more…)

Fri 20 Apr 2007

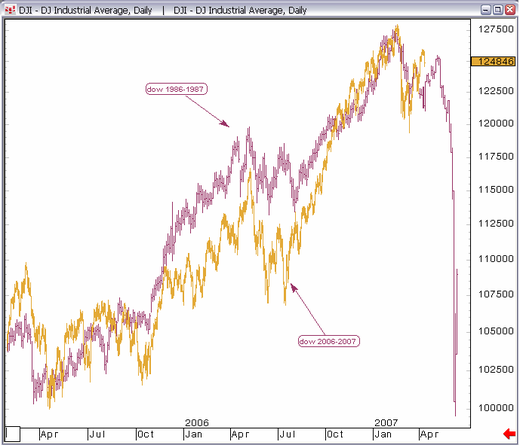

Though doing comparisons like this is specious, it is amusing how the two line up…

Here is a picture of the Dow Jones pre-1987 crash and the Dow Jones today.

Thu 19 Apr 2007

The Wall Street Journal has won a Pulitzer Prize for their series on options backdating.? The paper has made all the articles on the topic available to those of us without subscriptions…

The Perfect Payday: CEOs Reap Millions by Landing Stock Options When They Are Most Valuable March 18

How the Journal Analyzed Stock-Options Grants March 18

Five More Companies Show Questionable Options Pattern May 22

At HealthSouth, an Options Issue May 31

Monster Worldwide Gave Officials Options Ahead of Share Run-Ups June 12

During 1990s, Microsoft Practiced Variation of Options Backdating June 16

Executive Pay: The 9/11 Factor July 15

Setting the Date: How One Tech Company Played With Timing of Stock Options July 20

Stock-Options Criminal Charge: Slush Fund and Fake Employees Aug. 10

In Internal Probes of Stock Options, Conflicts Abound Aug. 11

As Companies Probe Backdating, More Top Officials Take a Fall Oct. 12

McGuire Faces Pressure to Leave at UnitedHealth Oct. 14

Embattled CEO To Step Down At UnitedHealth Oct. 16

Stock-Options Scandal Fugitive Puts Roots Down in Namibia Nov. 17

How a Giant Insurer Decided to Oust Hugely Successful CEO Dec. 7

How Backdating Helped Executives Cut Their Taxes Dec. 12

Bosses’ Pay: How Stock Options Became Part of the Problem Dec. 27

Living Large and Bouncing Back Dec. 30